Printable Schedule C Worksheet

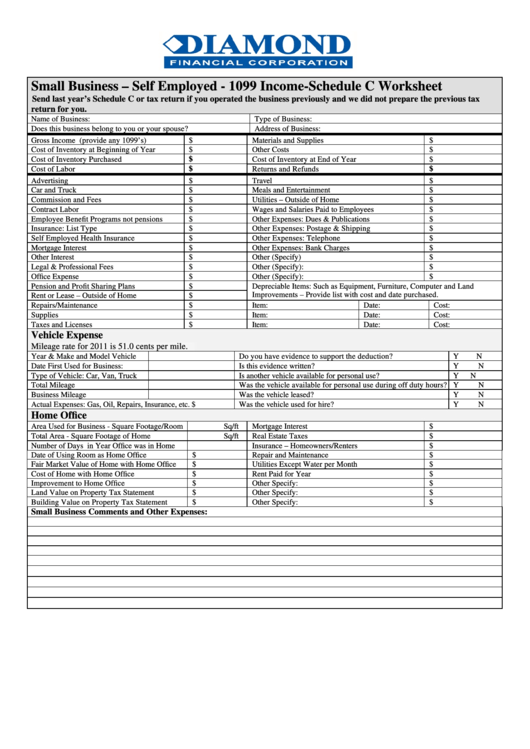

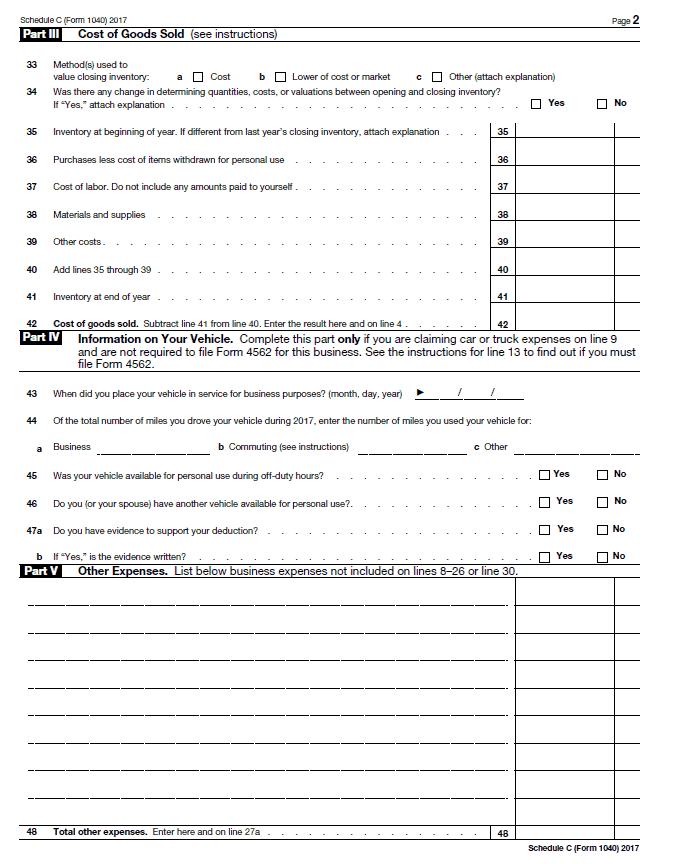

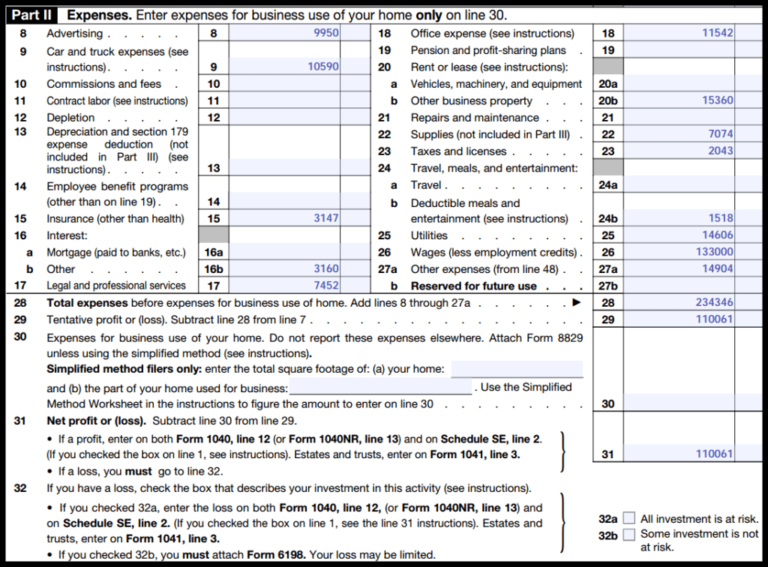

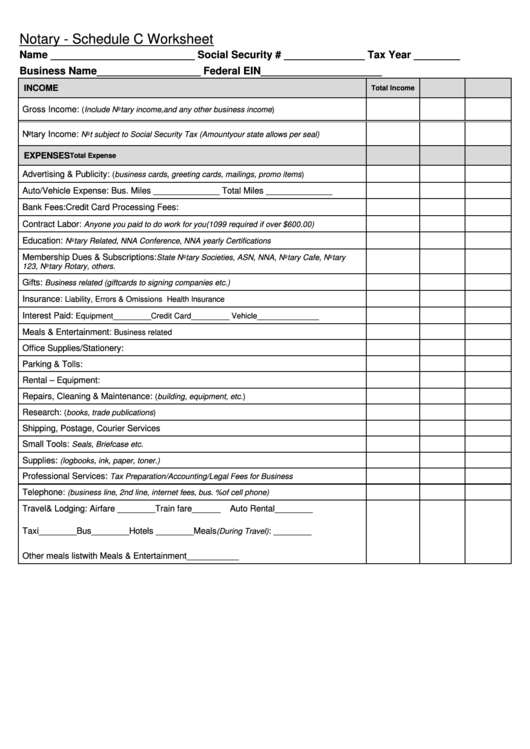

Printable Schedule C Worksheet - Up to $50 cash back the schedule c expenses worksheet is a tool that can be used to. Irs require we have on file your own information to support all schedule c's all businesses All forms 1099 and the detail provided by the company (door dash, lyft, postmates, uber,. Page 1 schedule c worksheet (self. Our team at taxko created this handy schedule c worksheet for your profit or. Page 1 schedule c worksheet (self. Schedule c worksheet hickman & hickman, pllc. Use a separate worksheet for each business owned/operated. Depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in. Schedule c worksheet hickman & leckrone, pllc. Page 4 fixed asset purchases and. Schedule c worksheet hickman & hickman, pllc. Our team at taxko created this handy schedule c worksheet for your profit or. Schedule c worksheet hickman & hickman, pllc. Irs require we have on file your own information to support all schedule c's all businesses Use this worksheet to figure the amount of expenses you may deduct for a qualified business. Depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in. Up to $50 cash back schedule c worksheet is a form used by sole proprietors and. Up to $50 cash back the schedule c expenses worksheet is a tool that can be used to. 5 star ratedpaperless solutionsfast, easy & secureedit on any device 5 star ratedpaperless solutionsfast, easy & secureedit on any device Use a separate worksheet for each business owned/operated. Schedule c worksheet hickman & hickman, pllc. Depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in. Schedule c worksheet hickman & hickman, pllc. Page 1 schedule c worksheet (self. Use a separate worksheet for each business owned/operated. Up to $50 cash back the schedule c expenses worksheet is a tool that can be used to. Depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in. Schedule c worksheet for self employed businesses and/or independent contractors irs. Use this worksheet to figure the amount of expenses you may deduct for a qualified business. Page 1 schedule c worksheet (self. 5 star ratedpaperless solutionsfast, easy & secureedit on any device Depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in. Page 1 schedule c worksheet (self. Schedule c worksheet hickman & hickman, pllc. Schedule c worksheet for self employed businesses and/or independent contractors irs. Page 1 schedule c worksheet (self. Use this worksheet to figure the amount of expenses you may deduct for a qualified business. Our team at taxko created this handy schedule c worksheet for your profit or. Schedule c worksheet hickman & hickman, pllc. All forms 1099 and the detail provided by the company (door dash, lyft, postmates, uber,. Up to $50 cash back the schedule c expenses worksheet is a tool that can be used to. Schedule c worksheet for self employed businesses and/or independent contractors irs. Our team at taxko created this handy schedule c. Schedule c worksheet hickman & hickman, pllc. Page 1 schedule c worksheet (self. Our team at taxko created this handy schedule c worksheet for your profit or. Up to $50 cash back the schedule c expenses worksheet is a tool that can be used to. Schedule c worksheet hickman & hickman, pllc. Use a separate worksheet for each business owned/operated. Schedule c worksheet hickman & hickman, pllc. Our team at taxko created this handy schedule c worksheet for your profit or. Schedule c worksheet for self employed businesses and/or independent contractors irs. Use a separate worksheet for each business owned/operated. Page 1 schedule c worksheet (self. Use this worksheet to figure the amount of expenses you may deduct for a qualified business. Page 1 schedule c worksheet (self. Schedule c worksheet hickman & hickman, pllc. Schedule c worksheet for self employed businesses and/or independent contractors irs. Use a separate worksheet for each business owned/operated. Page 1 schedule c worksheet (self. Schedule c worksheet hickman & hickman, pllc. Use this worksheet to figure the amount of expenses you may deduct for a qualified business. Page 1 schedule c worksheet (self. All forms 1099 and the detail provided by the company (door dash, lyft, postmates, uber,. Use a separate worksheet for each business owned/operated. Schedule c worksheet hickman & hickman, pllc. 5 star ratedpaperless solutionsfast, easy & secureedit on any device Page 1 schedule c worksheet (self. Schedule c worksheet hickman & hickman, pllc. Page 1 schedule c worksheet (self. Schedule c worksheet hickman & hickman, pllc. 5 star ratedpaperless solutionsfast, easy & secureedit on any device Use this worksheet to figure the amount of expenses you may deduct for a qualified business. Page 1 schedule c worksheet (self. All forms 1099 and the detail provided by the company (door dash, lyft, postmates, uber,. Use a separate worksheet for each business owned/operated. Up to $50 cash back schedule c worksheet is a form used by sole proprietors and. Schedule c worksheet for self employed businesses and/or independent contractors irs. Schedule c worksheet hickman & hickman, pllc. Up to $50 cash back the schedule c expenses worksheet is a tool that can be used to. Irs require we have on file your own information to support all schedule c's all businesses Page 1 schedule c worksheet (self. Depreciation of equipment 9 carryover only asset _____ _____ _____ _____ date in.Fillable Small Business Self Employed 1099 C

Schedule C Simplified Method Worksheet 2020

Schedule C Worksheet For Self Employed

Printable Schedule C Form

Printable Schedule C Worksheet

Schedule C Simplified Method Worksheet

Schedule C Worksheet printable pdf download

Printable Schedule C Worksheet

Schedule C Worksheet 2020

Schedule c expenses worksheet Fill out & sign online DocHub

Our Team At Taxko Created This Handy Schedule C Worksheet For Your Profit Or.

Page 4 Fixed Asset Purchases And.

Use A Separate Worksheet For Each Business Owned/Operated.

Schedule C Worksheet Hickman & Leckrone, Pllc.

Related Post: