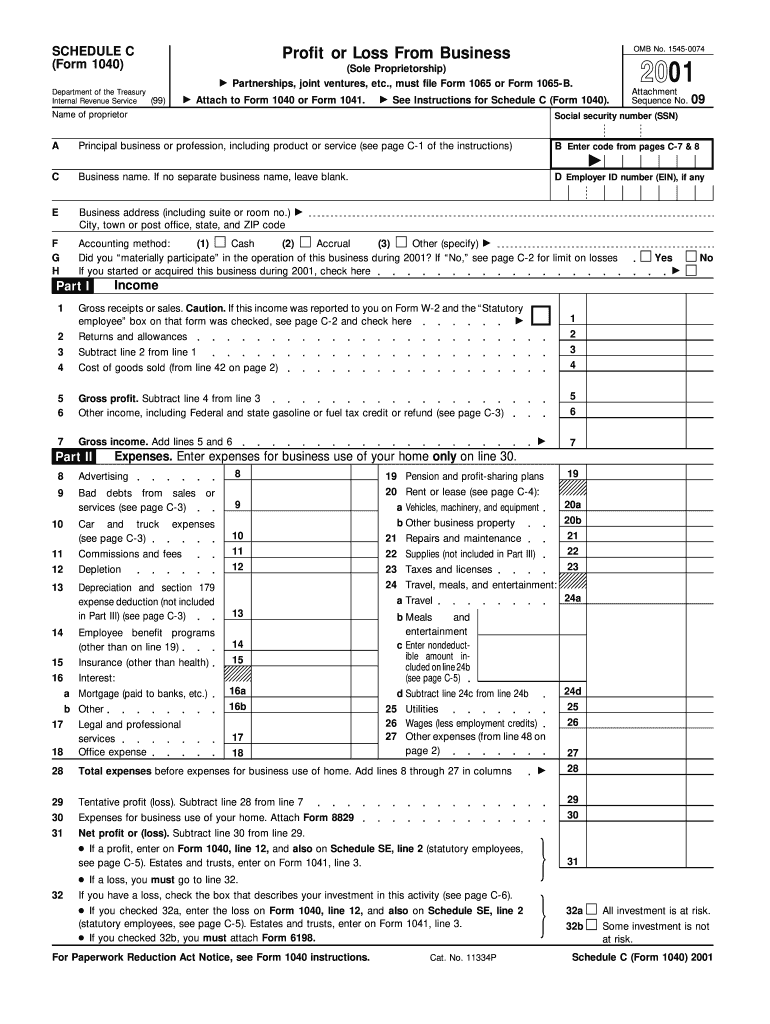

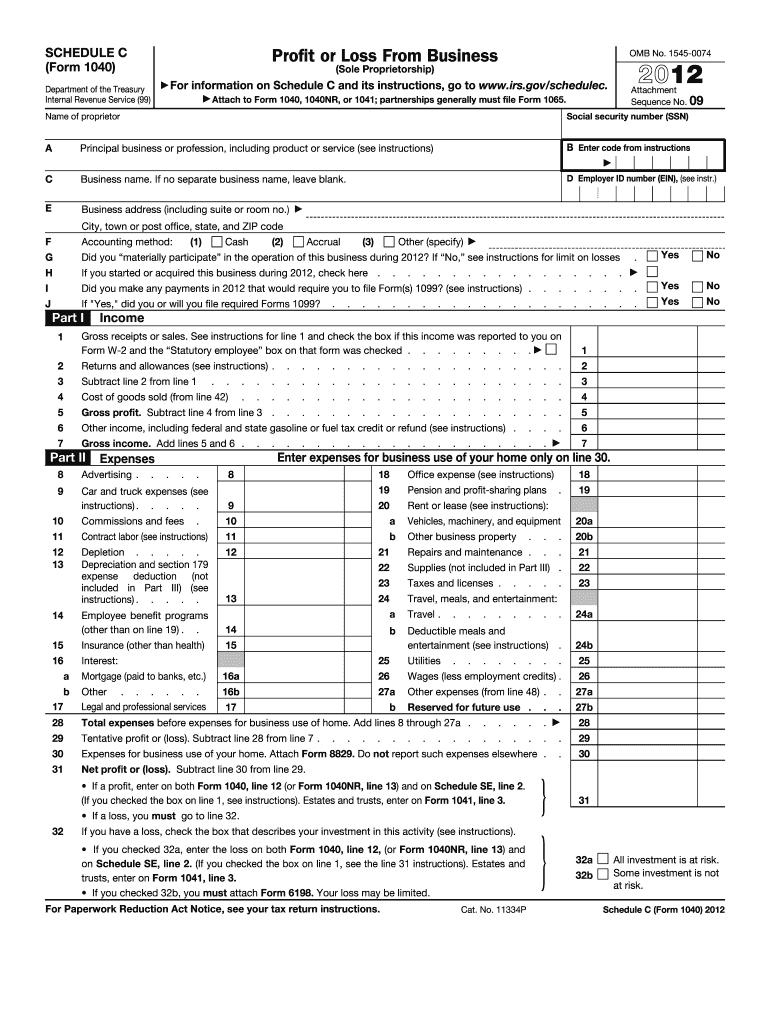

Printable Schedule C Tax Form

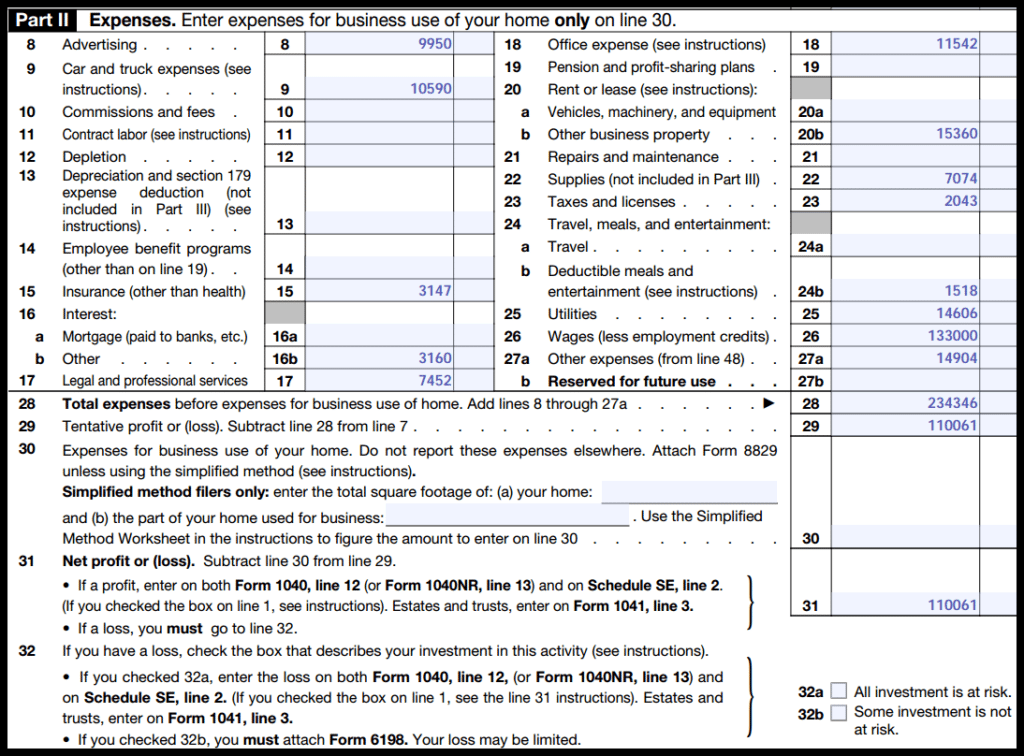

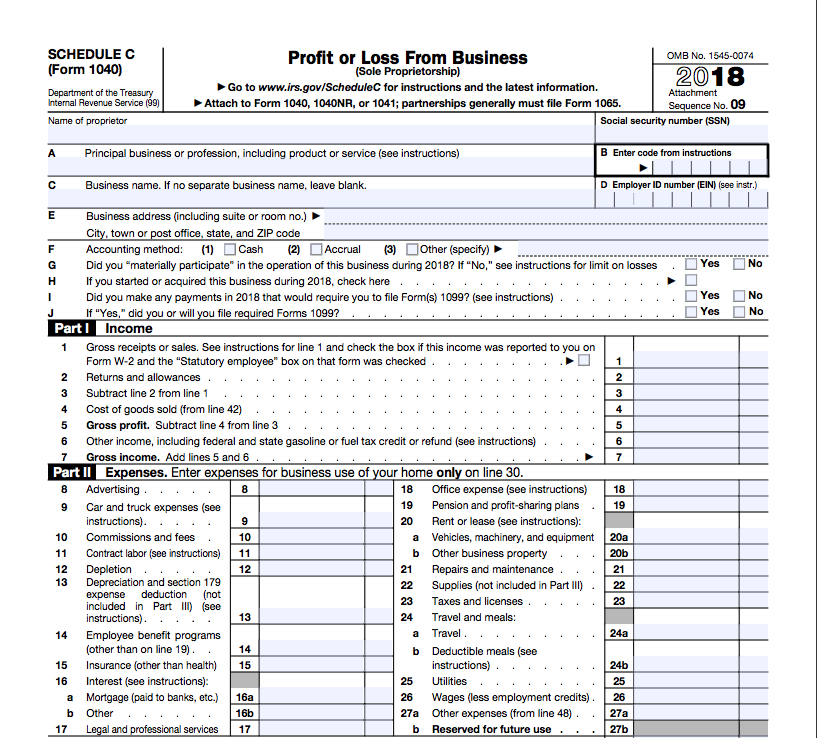

Printable Schedule C Tax Form - An activity qualifies as a business if Partnerships must generally file form 1065. Treasury/irs schedule c (form 1040) department of the treasury internal revenue service. Schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule c and its separate instructions is at www.irs.gov/schedulec. Partnerships generally must file form 1065. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships must generally file form 1065. Includes recent updates, related forms, and instructions on how to file. Attach to form 1040, 1040nr, or 1041; An activity qualifies as a business if Go to www.irs.gov/schedulec for instructions and the latest information. Treasury/irs schedule c (form 1040) department of the treasury internal revenue service. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. An activity qualifies as a business if Partnerships must generally file form 1065. Partnerships generally must file form 1065. Partnerships must generally file form 1065. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a. Go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. An activity qualifies as a. An activity qualifies as a business if Partnerships must generally file form 1065. Attach to form 1040, 1040nr, or 1041; Partnerships must generally file form 1065. Includes recent updates, related forms, and instructions on how to file. Partnerships must generally file form 1065. Go to www.irs.gov/schedulec for instructions and the latest information. Treasury/irs schedule c (form 1040) department of the treasury internal revenue service. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if Go to www.irs.gov/schedulec for instructions and the latest information. Attach to form 1040, 1040nr, or 1041; Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c (form 1040) to report income or (loss) from a business you operated or. Go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if Partnerships must generally file form 1065. Includes recent updates, related forms, and instructions on how to file. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest. Go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships must generally file form 1065. Treasury/irs schedule c (form 1040) department of the treasury internal revenue service. Partnerships must generally file form 1065. Attach to form 1040, 1040nr, or 1041; Partnerships must generally file form 1065. Includes recent updates, related forms, and instructions on how to file. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Schedule c (form 1040) 2015 profit or loss from business (sole proprietorship). An activity qualifies as a business if Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Treasury/irs schedule c (form 1040) department of the treasury internal revenue service. Schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99) information about schedule c and its separate instructions is at www.irs.gov/schedulec. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. Go to www.irs.gov/schedulec for instructions and the latest information. Includes recent updates, related forms, and instructions on how to file. An activity qualifies as a business if Partnerships must generally file form 1065. An activity qualifies as a business if Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships must generally file form 1065. Partnerships generally must file form 1065.2020 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

20182024 Form IRS 1040 Schedule CEZ Fill Online, Printable

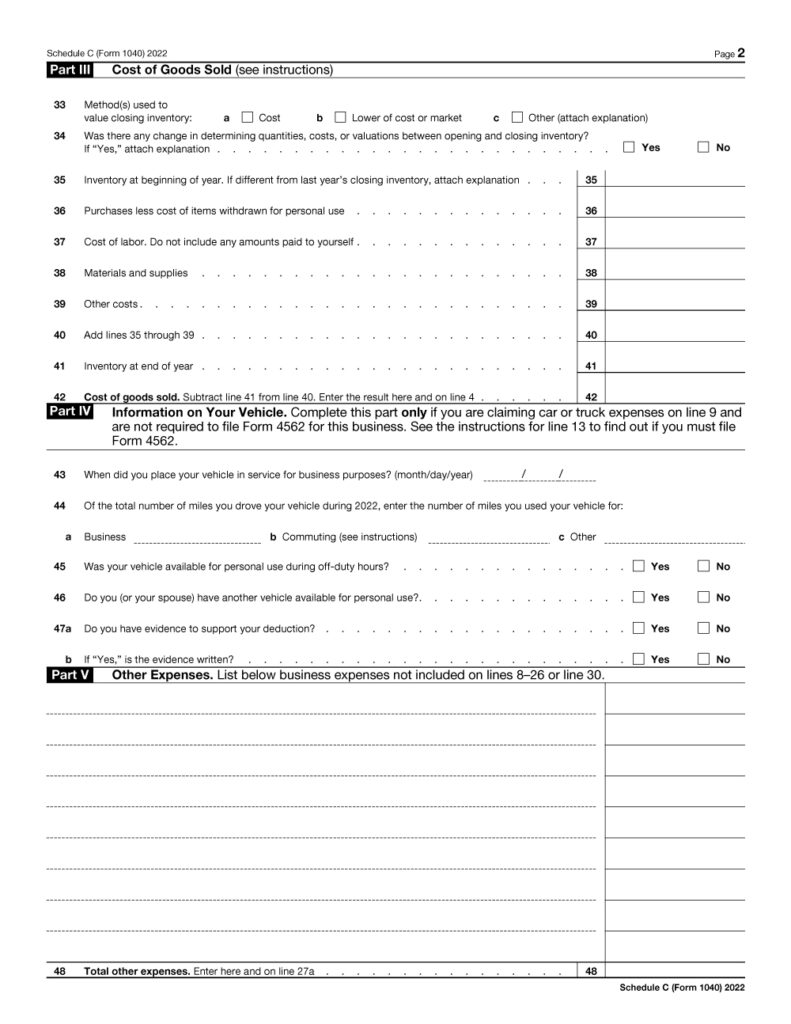

Schedule C (Form 1040) Expense Cost Of Goods Sold

Printable Schedule C Tax Form Stephenson

2001 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

Schedule C (Form 1040) 2023 Instructions

How to Complete Schedule C Profit and Loss From a Business

Free Printable Schedule C Tax Form

Fill Free fillable Profit or Loss From Business Schedule C Form 1040

1040 Schedule C 20122024 Form Fill Out and Sign Printable PDF

Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service (99) Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

An Activity Qualifies As A Business If Your Primary Purpose For Engaging In The Activity Is For Income Or Profit And You Are Involved In The Activity With Continuity And Regularity.

Partnerships Must Generally File Form 1065.

Attach To Form 1040, 1040Nr, Or 1041;

Related Post: