Printable Nc40 Tax Form

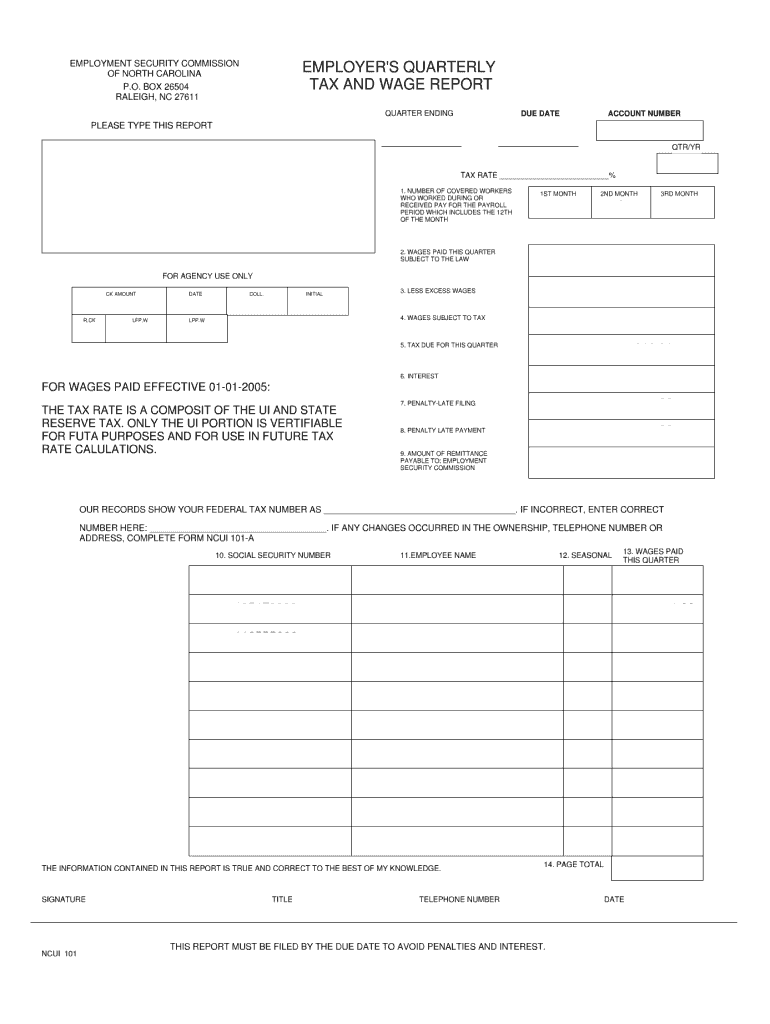

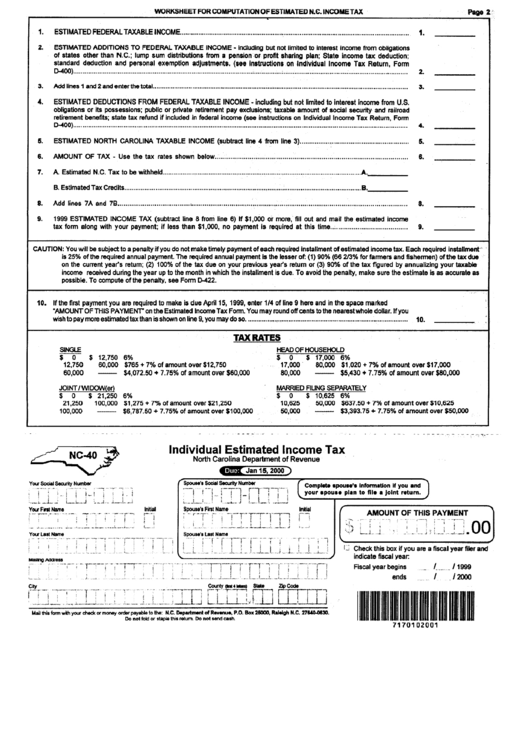

Printable Nc40 Tax Form - Taxformfinder provides printable pdf copies of 45 current north carolina income tax. Use this form for payments that are due on april 15, 2024, june 17, 2024, september 16, 2024, and january 15, 2025. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Schedule payments up to 365 days in advance; Ncdor has recently redesigned its website. It appears you don't have a pdf plugin for this browser. Sales & use tax forms. You can use this form to make all of your estimated income tax payments for the year. Web amended individual income tax; North carolina — individual estimated income tax. Use efile to schedule payments for the entire year. Nrs report of sale of real property by nonresidents: Web released on august 1, 2016; What is individual estimated income tax? Web 2023 individual income tax forms. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. • you will be 65 or older during 2024. North carolina — individual estimated income tax. Click here for help if the form does not appear after you click create form. For details, visit www.dornc.com and search for online and pay. Web amended individual income tax; Request certain forms from idor. The latest edition provided by the north carolina department of revenue; Want to schedule all four payments? Complete this web form for assistance. Complete this web form for assistance. Tax you expect to have. Before viewing these documents you may need to download adobe acrobat reader. Web to pay individual estimated income tax: North carolina — individual estimated income tax. Web form tax year description electronic options; • your total household income in 2023 was $65,000 or less. Instead of filing this form, you may pay your estimated tax online. Web 2023 individual income tax forms. If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. You can use this form to make all of your estimated income tax payments for the year. Sales & use tax forms. Nrs report of sale of real property by nonresidents: North carolina — individual estimated income tax. North carolina has a flat state income tax of 4.75% , which is administered by the north carolina department of revenue. Complete this web form for assistance. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web amended individual income tax; However, you may pay your estimated tax online. Web if you want to download a tax form, use the navigation above, search the site, or choose a link below: Web if you want to download a tax form, use the navigation above, search the site, or choose a link below: 1 ,,___(8) do not mix form types. Fill out the form in our online filing application. For details, visit www.dornc.com and search for online and pay. However, you may pay your estimated tax online. Easy to use and ready to print; Use efile to schedule payments for the entire year. • on january 1, 2023, and january 1, 2024, you. Tax you expect to have. Sales & use tax forms. The latest edition provided by the north carolina department of revenue; “estimated income tax” is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim. Tax you expect to have. Want to schedule all four payments?. Schedule payments up to 365 days in advance; Ncdor has recently redesigned its website. It appears you don't have a pdf plugin for this browser. For details, visit www.dornc.com and search for online and pay. What is individual estimated income tax? Use the create form button located below to generate the printable form. • your total household income in 2023 was $65,000 or less. You can use this form to make all of your estimated income tax payments for the year. Schedule payments up to 365 days in advance; Web north carolina printable income tax forms 45 pdfs. “estimated income tax” is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim. Use efile to schedule payments for the entire year. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Nrs report of sale of real property by nonresidents: You can print other north carolina tax forms here. Tax you expect to have. Who must make estimated income tax payments. What is individual estimated income tax? North carolina — individual estimated income tax. You can use this form to make all of your estimated income tax payments for the year. North carolina has a flat state income tax of 4.75% , which is administered by the north carolina department of revenue. Request certain forms from idor. • your total household income in 2023 was $65,000 or less. • you will be 65 or older during 2024. Estimated tax payments must be sent to the north carolina department of revenue on a quarterly basis. Income tax you expect to owe for the year, minus;Nc Quarterly Tax And Wage Report Fill Online, Printable, Fillable

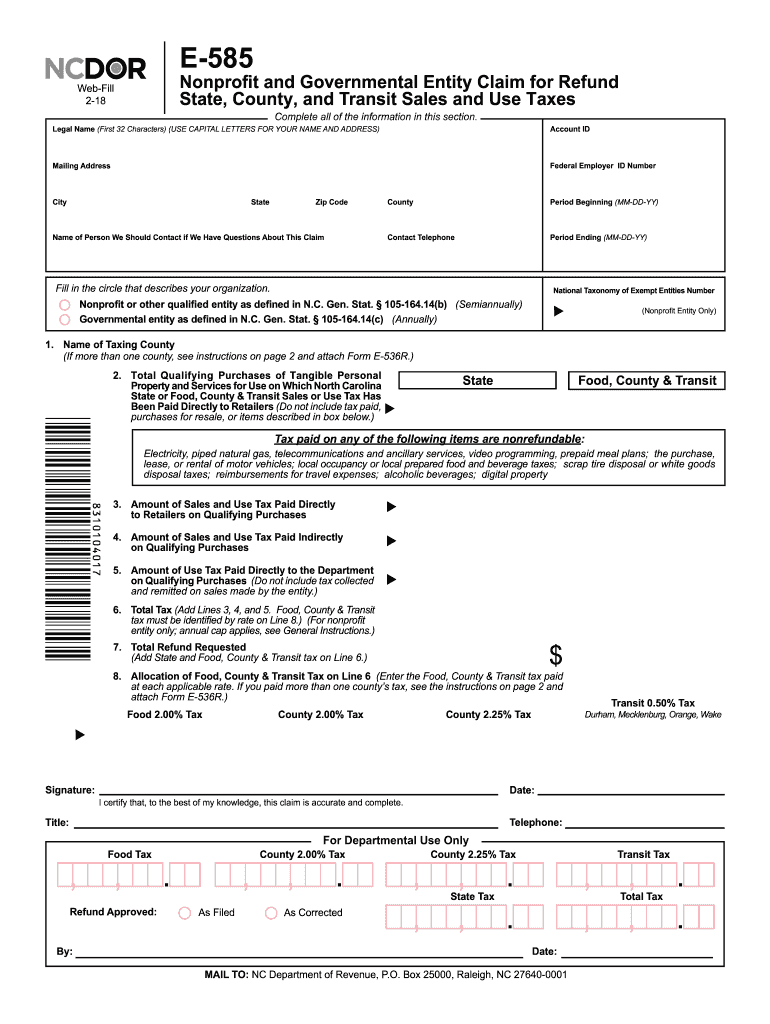

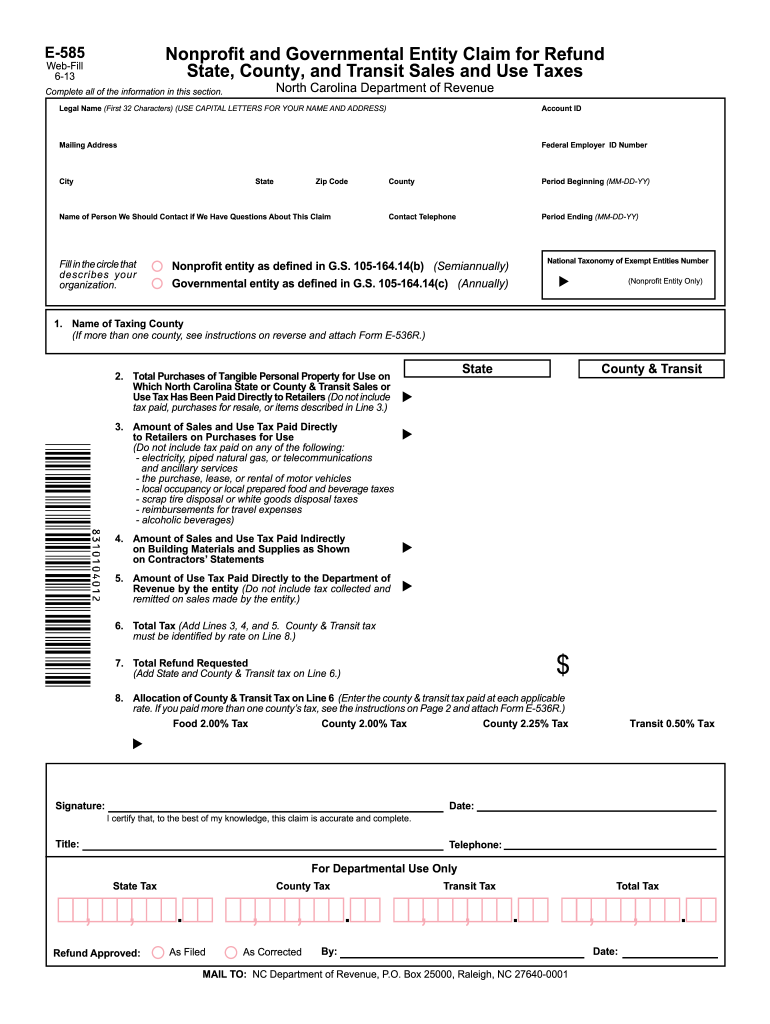

Ncdor form e 585 Fill out & sign online DocHub

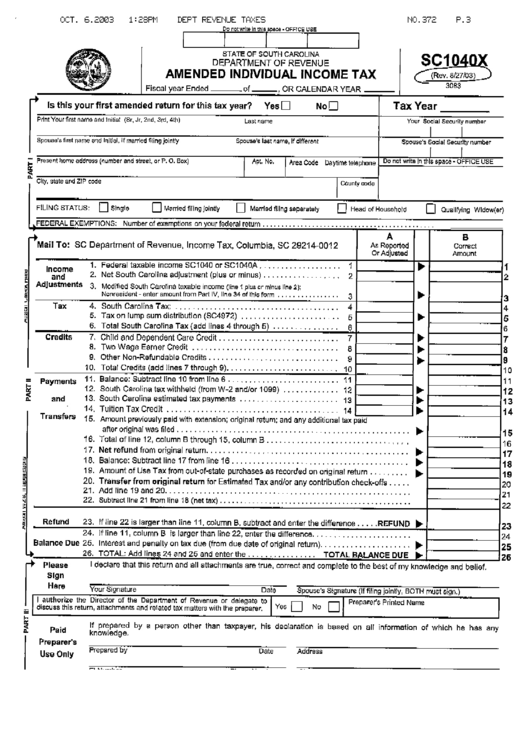

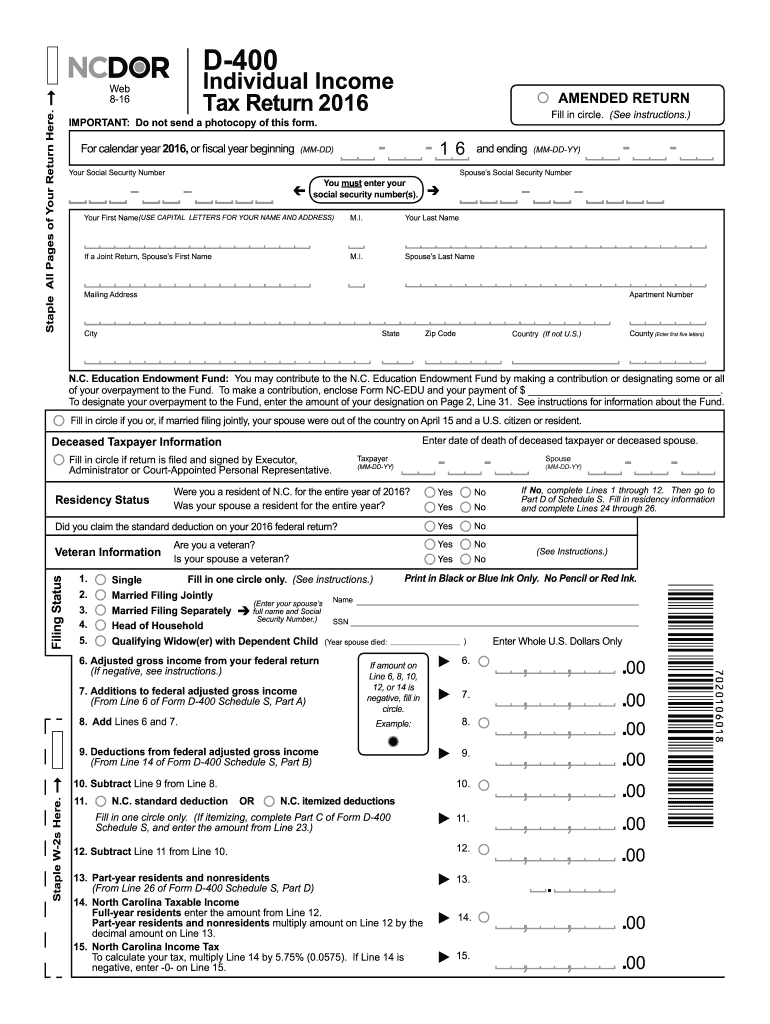

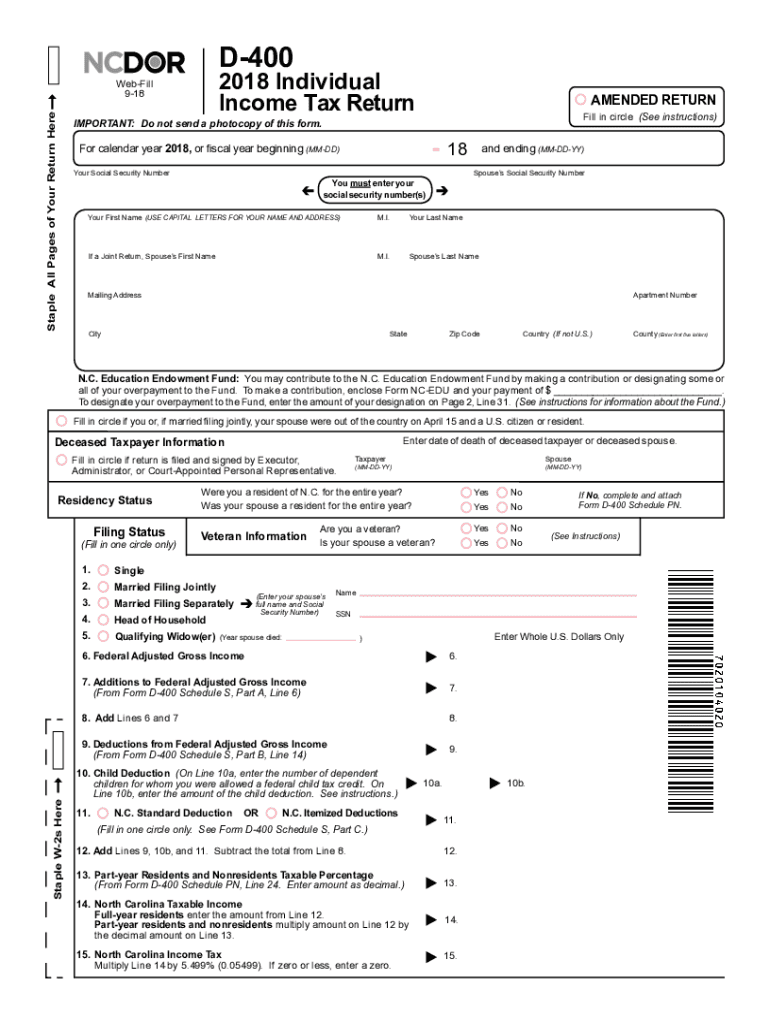

Individual Tax Return North Carolina Free Download

Nc40 Printable Form

Fillable Form Nc40 Individual Estimated Tax printable pdf

NC DoR NC4 EZ 20192022 Fill out Tax Template Online US Legal Forms

NC D400 for Form Fill Out and Sign Printable PDF Template signNow

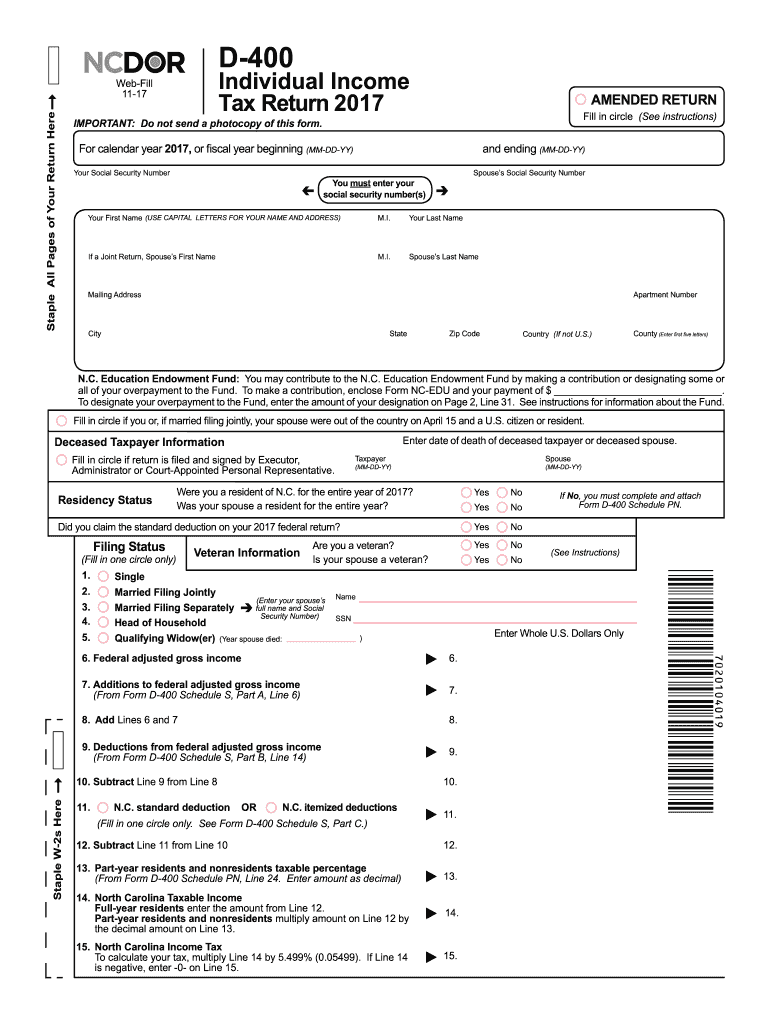

2017 north carolina tax form Fill out & sign online DocHub

Printable Nc 40 Tax Form

North Carolina Tax Rate Form Fill Out and Sign Printable PDF

Extension For Filing Individual Income Tax Return;

The Latest Edition Provided By The North Carolina Department Of Revenue;

Ncdor Has Recently Redesigned Its Website.

It Appears You Don't Have A Pdf Plugin For This Browser.

Related Post: