Printable Form 941

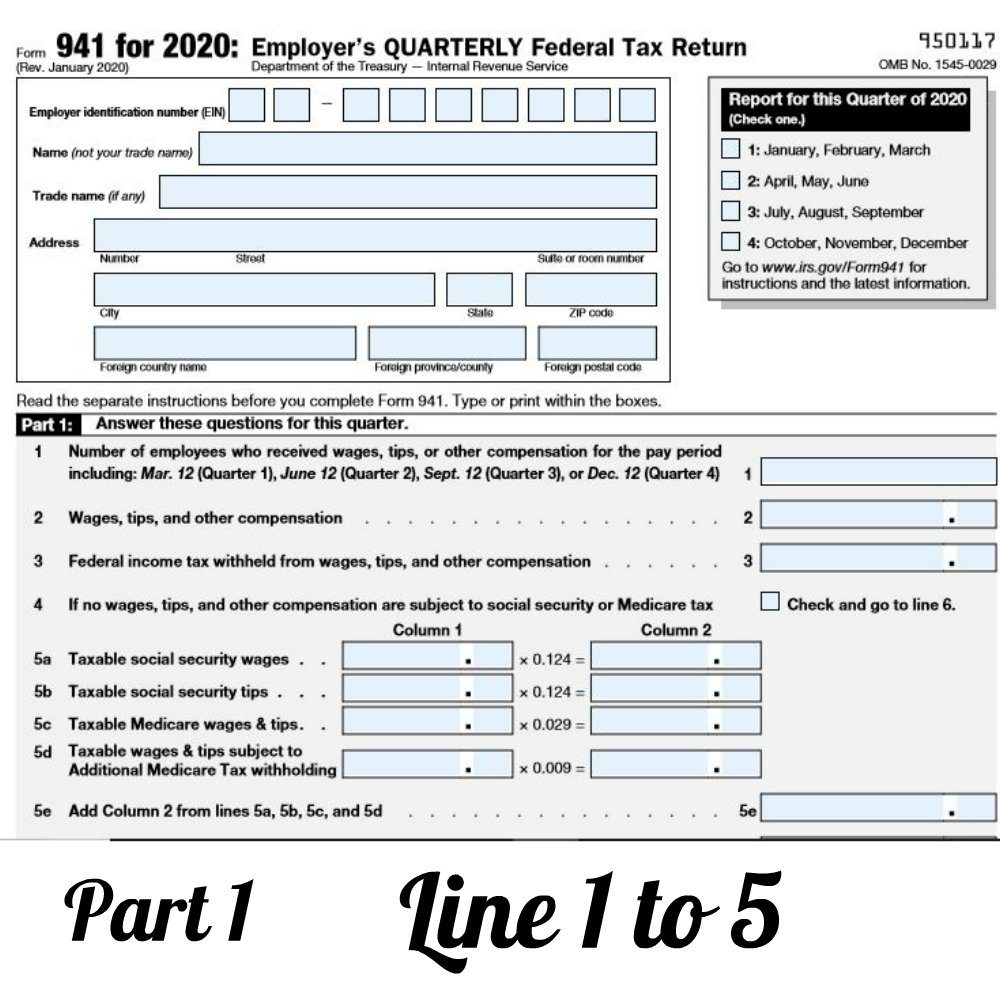

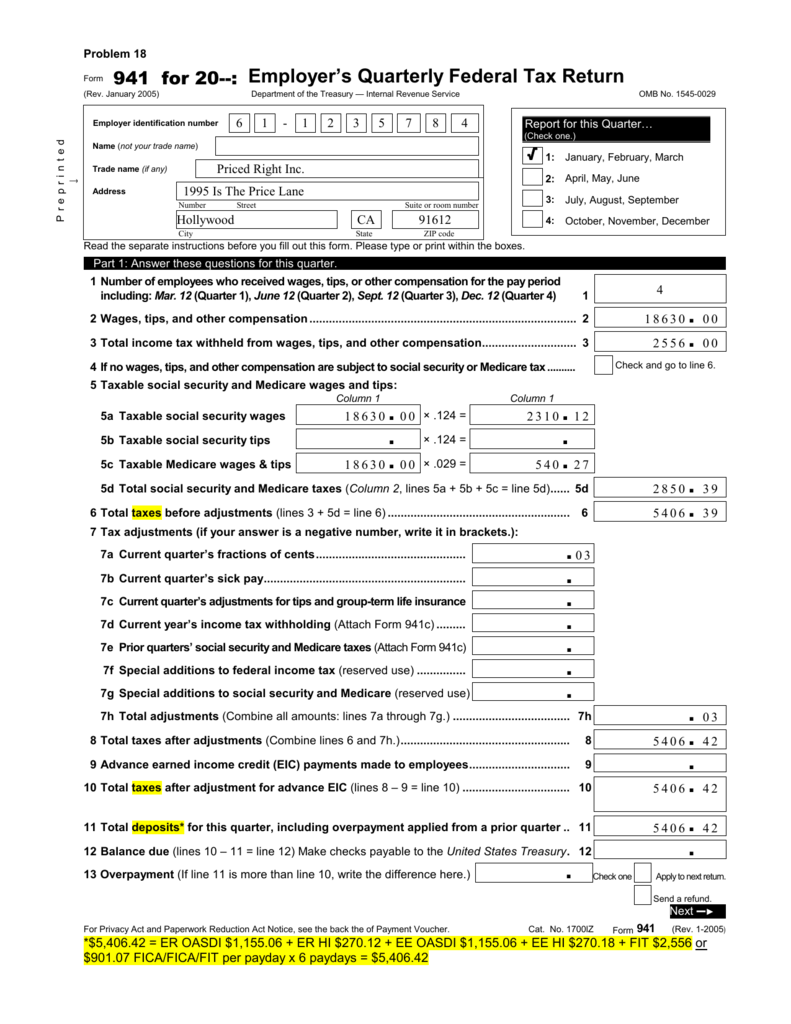

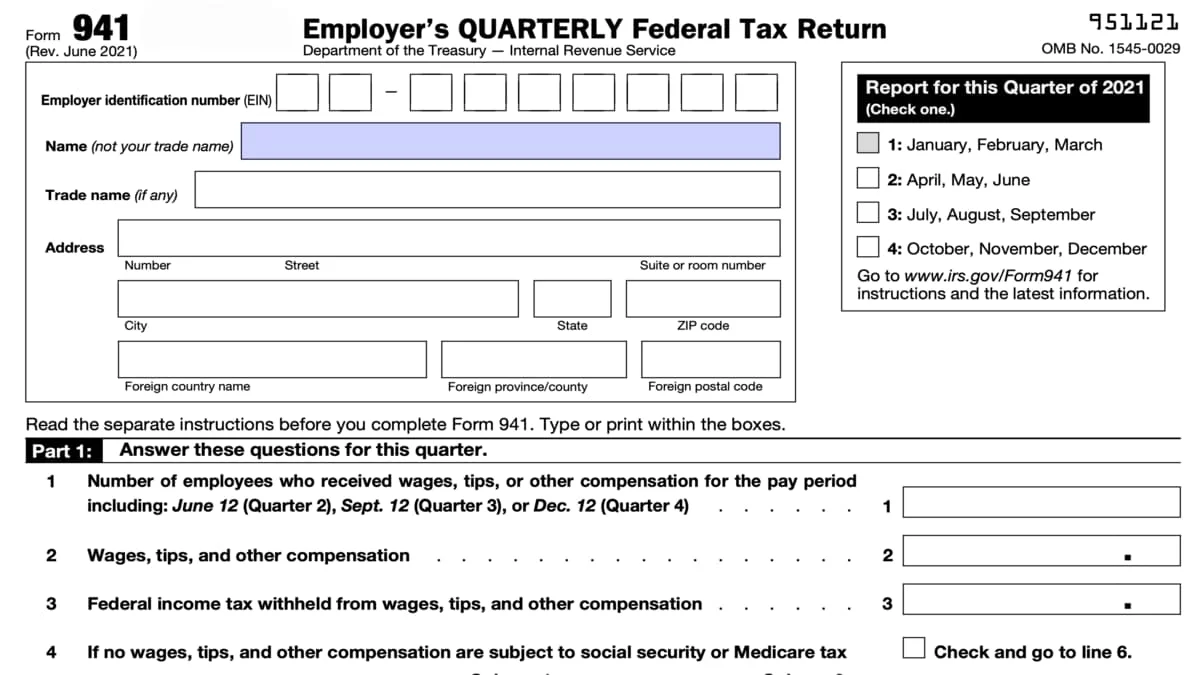

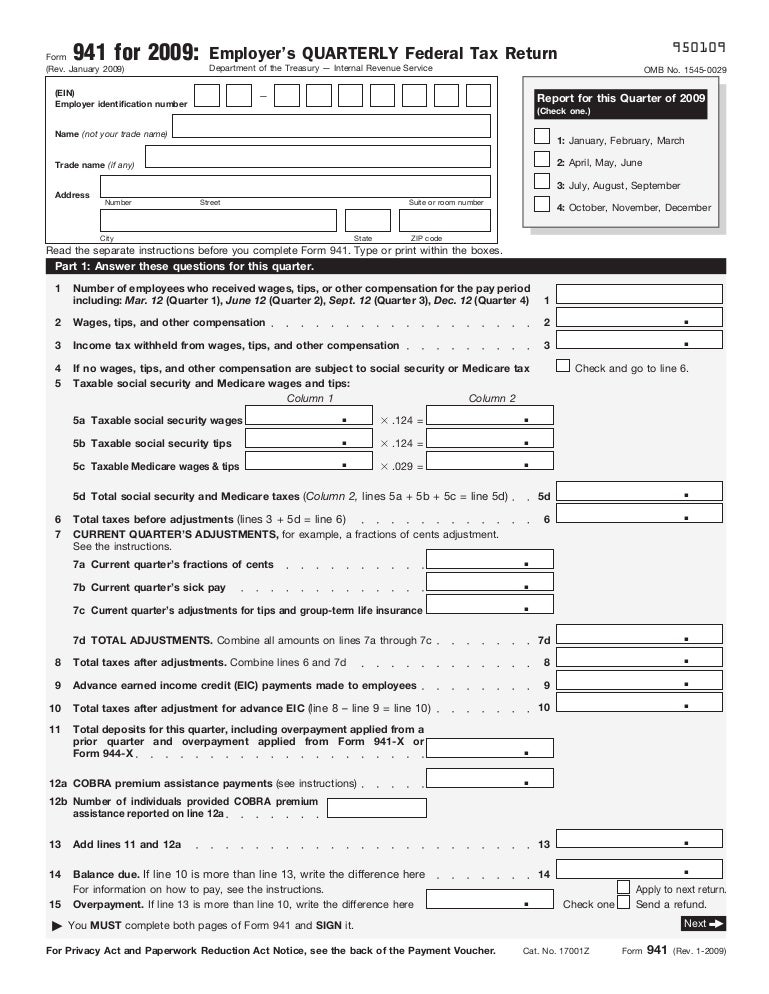

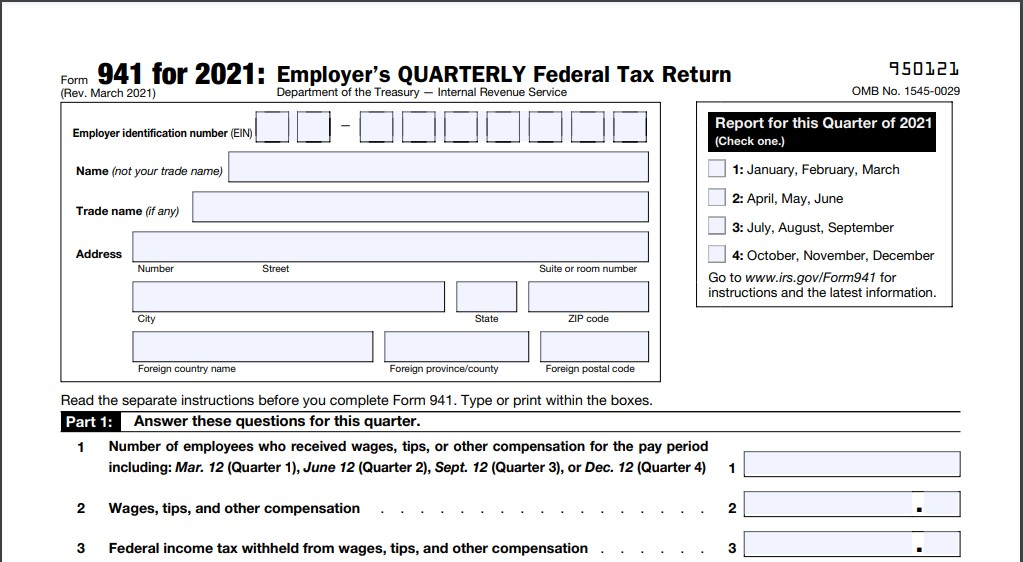

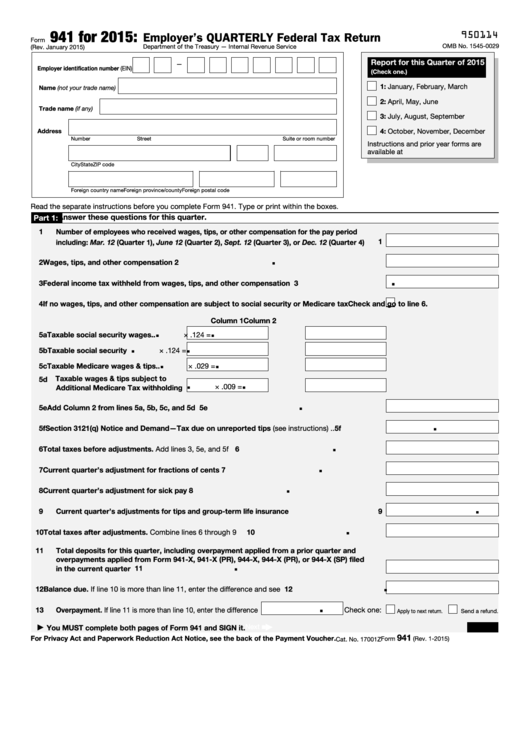

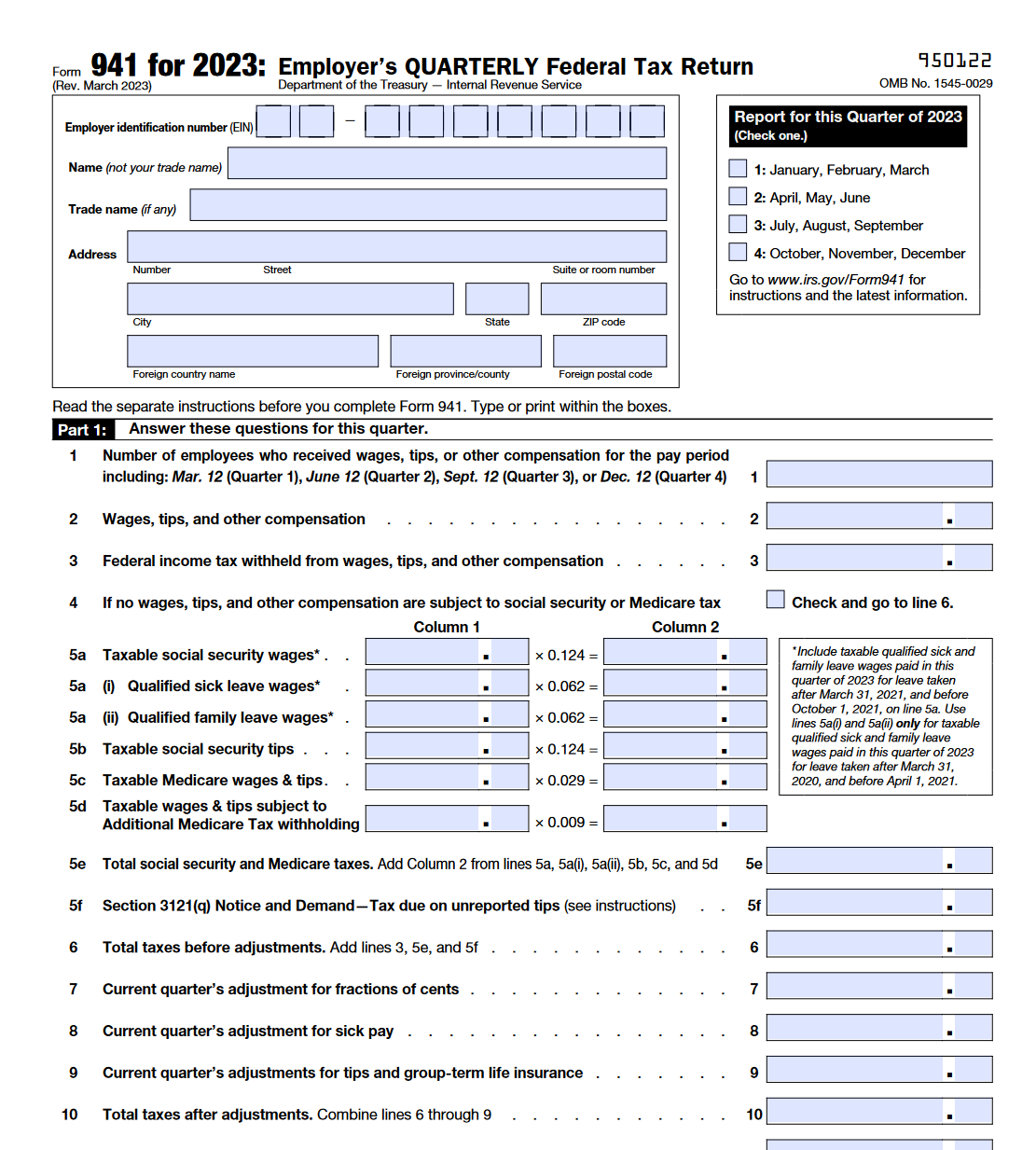

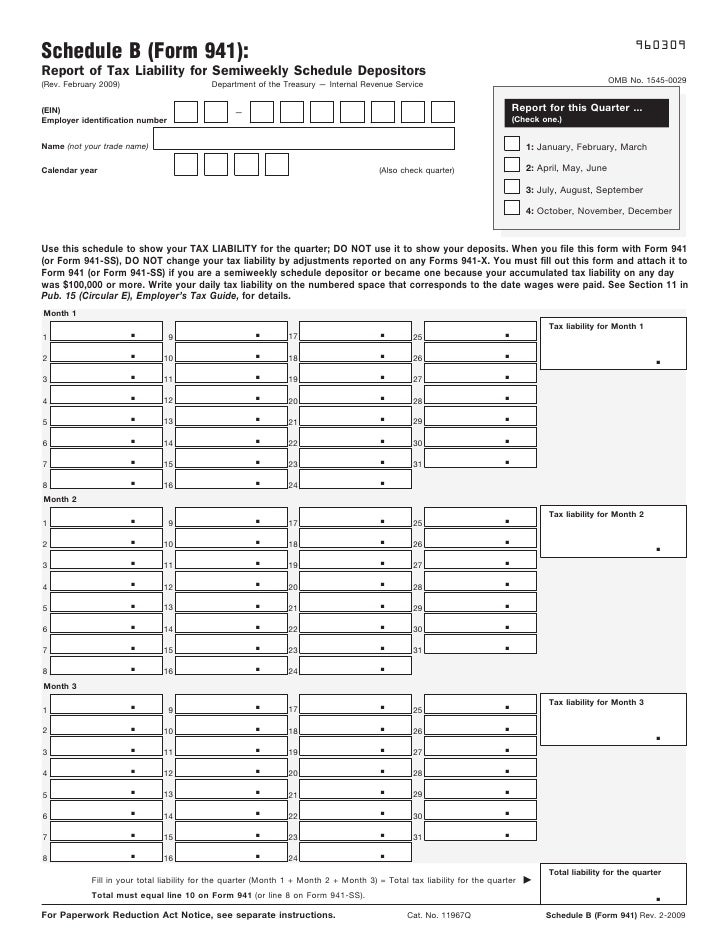

Printable Form 941 - Type or print within the boxes. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's. Form 941 employer's quarterly federal tax return. Let's look at what information is required on. Above is a fillable pdf version that you can print or download. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. If you have employees, you must file form 941 to report any federal withholdings. Form 941 is used by employers who withhold. Answer these questions for this quarter. Type or print within the boxes. Form 941 employer's quarterly federal tax return. Form 941 is used by employers who withhold. Number of employees who received wages,. This guide provides the basics of the 941 form, instructions to help you fill it out, and where. Above is a fillable pdf version that you can print or download. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's. Answer these questions for this quarter. This form determines your payroll tax liability for the quarter. Type or print within the boxes. Read the separate instructions before you complete form 941. Number of employees who received wages,. This guide provides the basics of the 941 form, instructions to help you fill it out, and where. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Read the separate instructions before you complete form 941. Answer these questions for this quarter. Form 941 employer's quarterly federal tax return. Read the separate instructions before you complete form 941. Wages, tips, and other compensation. This guide provides the basics of the 941 form, instructions to help you fill it out, and where. Wages, tips, and other compensation. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's. Type or print within the boxes. Number of employees who received wages,. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. This form determines your payroll tax liability for the quarter. Most businesses must report and file tax returns quarterly using the irs form 941. Answer these questions for this quarter. Answer these questions for this quarter. Type or print within the boxes. Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be. Read the separate instructions before you complete form 941. Information about form 941, employer's quarterly federal tax return, including recent updates,. Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be. Most businesses must report and file tax returns quarterly using the irs form 941. Above is a fillable pdf version that you can print or download. This. Wages, tips, and other compensation. This guide provides the basics of the 941 form, instructions to help you fill it out, and where. Number of employees who received wages,. Answer these questions for this quarter. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Read the separate instructions before you complete form 941. Answer these questions for this quarter. Form 941 is used by employers who withhold. Type or print within the boxes. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Answer these questions for this quarter. Type or print within the boxes. Answer these questions for this quarter. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have. Above is a fillable pdf version that you can print or download. Read the separate instructions before you complete form 941. Type or print within the boxes. Answer these questions for this. Let's look at what information is required on. Number of employees who received wages,. Here’s a guide to how the revised 941 works, with instructions for completing yours, and a downloadable pdf of. Type or print within the boxes. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's. Answer these questions for this quarter. If you have employees, you must file form 941 to report any federal withholdings. Read the separate instructions before you complete form 941. This form determines your payroll tax liability for the quarter. Form 941 is used by employers who withhold. Read the separate instructions before you complete form 941. Effective for tax periods beginning after december 31, 2023, the lines used to claim the credit for qualified sick and family leave wages have been removed from form 941 because it would be. Most businesses must report and file tax returns quarterly using the irs form 941. Read the separate instructions before you complete form 941. Irs form 941, employer's quarterly federal tax return , is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have. Answer these questions for this quarter.Irs Form Fillable And Savable And Mail Printable Forms Free Online

Form 941 for 20 Employer's Quarterly Federal Tax Return

941 Form 2022 Printable PDF Template

Form 941 Employer's Quarterly Federal Tax Return

Printable 941 Form 2021 Printable Form 2024

How to fill out IRS form 941 20222023 PDF Expert

Fillable Form 941 Employer S Quarterly Federal Tax Printable Form 2022

IRS Form 941. Employer’s QUARTERLY Federal Tax Return Forms Docs 2023

How to fill out IRS Form 941 2019 PDF Expert

Form 941 Employer's Quarterly Federal Tax Return Form 941 Employer…

Above Is A Fillable Pdf Version That You Can Print Or Download.

This Guide Provides The Basics Of The 941 Form, Instructions To Help You Fill It Out, And Where.

Form 941 Employer's Quarterly Federal Tax Return.

Answer These Questions For This Quarter.

Related Post: