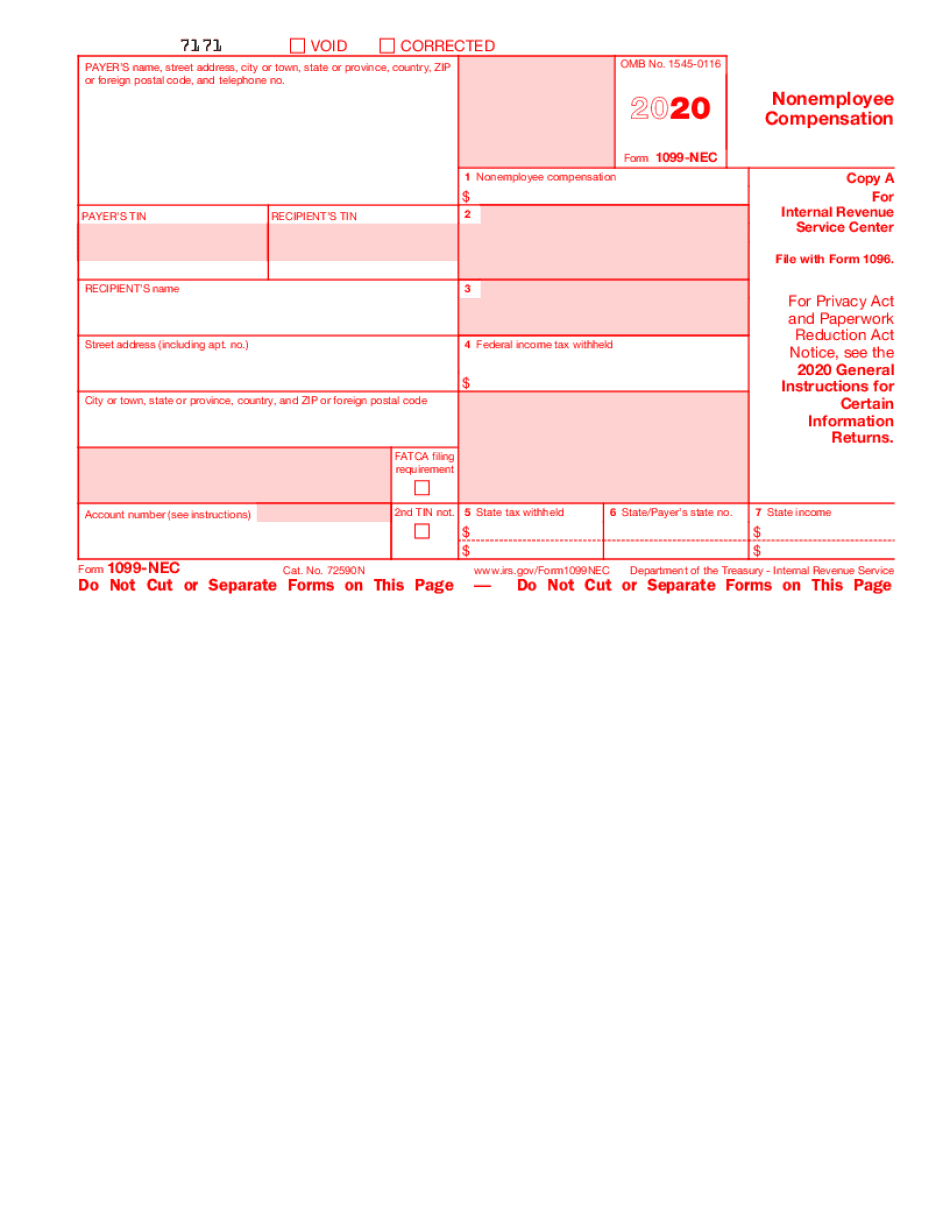

Printable Blank 1099 Nec Form

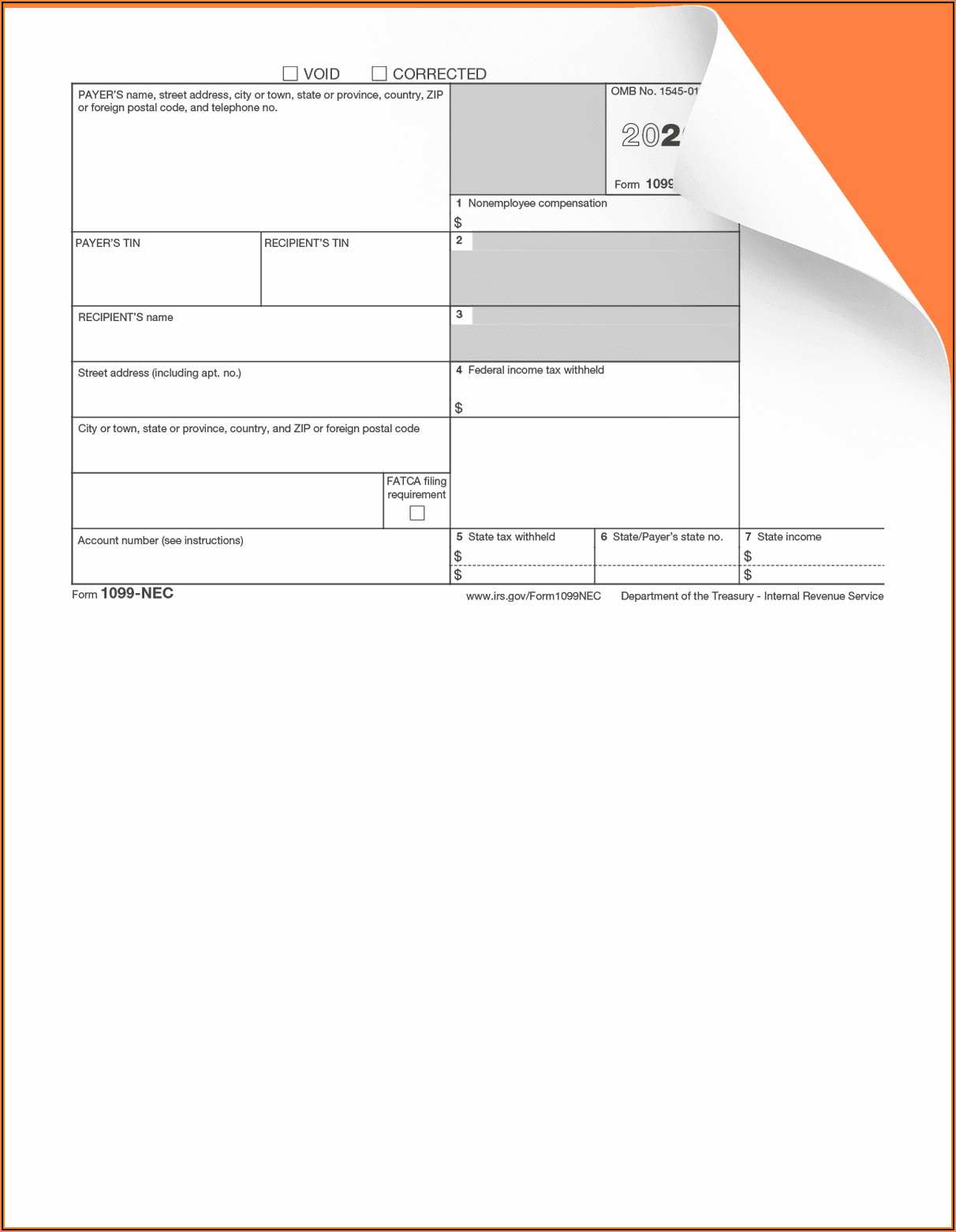

Printable Blank 1099 Nec Form - Follow the simple instructions below: Completing and filing this tax form is easy. Web convert and save your form 1099 nec as pdf (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Click the fill out form button. To order these instructions and additional forms, go to www.irs.gov/employerforms. Web now, creating a 1099 nec pdf requires a maximum of 5 minutes. Review the form you want to print and select view selected 1099 contractors to confirm your contractors. You paid them in cash, check, or direct deposit To ensure you have all the necessary information, you can download sample printable forms for reference. All forms are printable and downloadable. Write your and the recipient's tin. Business, tax, legal as well as other documents need an advanced level of protection and compliance with the law. Use get form or simply click on the template preview to open it in the editor. Web quick steps to complete and design print 1099 form 2020 online: Enter the recipient's name in the space provided. To ensure you have all the necessary information, you can download sample printable forms for reference. Find the web sample in the catalogue. Enter the total amount of the nonemployee compensation in the space provided. Web convert and save your form 1099 nec as pdf (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). You paid them in cash, check, or direct deposit Enter the payer's name, address, and zip code in the space provided. Specify the date range for the forms, then select all vendors you wish to print 1099s. Review the form you want to print and select view selected 1099 contractors to confirm your contractors. Simply fill in the appropriate boxes according to the definition of the boxes you learned. Web convert and save your form 1099 nec as pdf (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Write your and the recipient's tin. Follow the simple instructions below: Business, tax, legal as well as other documents need an advanced level of protection and compliance with the law. Enter the payer's name, address, and zip code in the. Enter all necessary information in the required fillable areas. Review the form you want to print and select view selected 1099 contractors to confirm your contractors. Web there are a few points to cover when preparing to file a 1099. You paid at least $600 or more in a single year. Get your online template and fill it in using. Once completed you can sign your fillable form or send for signing. Simple, and easy to use no software downloads or installation required. Enter all necessary information in the required fillable areas. To order these instructions and additional forms, go to www.irs.gov/employerforms. Next write federal income tax that was withheld. Specify your information in the first field. Write your and the recipient's tin. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Simply fill in the appropriate boxes according to the definition of the boxes you learned about in this guide. Completing and. Enter all necessary information in the required fillable areas. Once completed you can sign your fillable form or send for signing. Business, tax, legal as well as other documents need an advanced level of protection and compliance with the law. Select print 1096s instead, if printing form 1096. Write your and the recipient's tin. All forms are printable and downloadable. Specify your information in the first field. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web there are a few points to cover when preparing to file a 1099. Specify the date range for the forms, then select all vendors you wish to print. Start completing the fillable fields and carefully type in required information. Once completed you can sign your fillable form or send for signing. Specify your information in the first field. Completing and filing this tax form is easy. Web there are a few points to cover when preparing to file a 1099. Specify the date range for the forms, then select all vendors you wish to print 1099s. Start completing the fillable fields and carefully type in required information. Write your and the recipient's tin. You paid them in cash, check, or direct deposit You paid at least $600 or more in a single year. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Review the form you want to print and select view selected 1099 contractors to confirm your contractors. Web now, creating a 1099 nec pdf requires a maximum of 5 minutes. Web there are a. Next write federal income tax that was withheld. To order these instructions and additional forms, go to www.irs.gov/form1099nec. Comply with our simple steps to get your 1099 nec pdf prepared quickly: Tap the print on 1099 forms button, then print to complete your printing. Web now, creating a 1099 nec pdf requires a maximum of 5 minutes. Write your and the recipient's tin. Web once the form is aligned, click next. Web how to fill out and sign 2020 1099 nec form online? You paid at least $600 or more in a single year. Find the web sample in the catalogue. You paid them in cash, check, or direct deposit Select print 1096s instead, if printing form 1096. 50 sheets per pack, 2 forms per sheet. Enter the payer's name, address, and zip code in the space provided. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web there are a few points to cover when preparing to file a 1099.2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

How to File Your Taxes if You Received a Form 1099NEC

Form 1099 Nec Printable Blank PDF Online

Form1099NEC

Blank 1099 Nec Fill and Sign Printable Template Online US Legal Forms

Form 1099NEC Nonemployee Compensation, State Copy 1

Form 1099NEC Nonemployee Compensation, Recipient Copy B

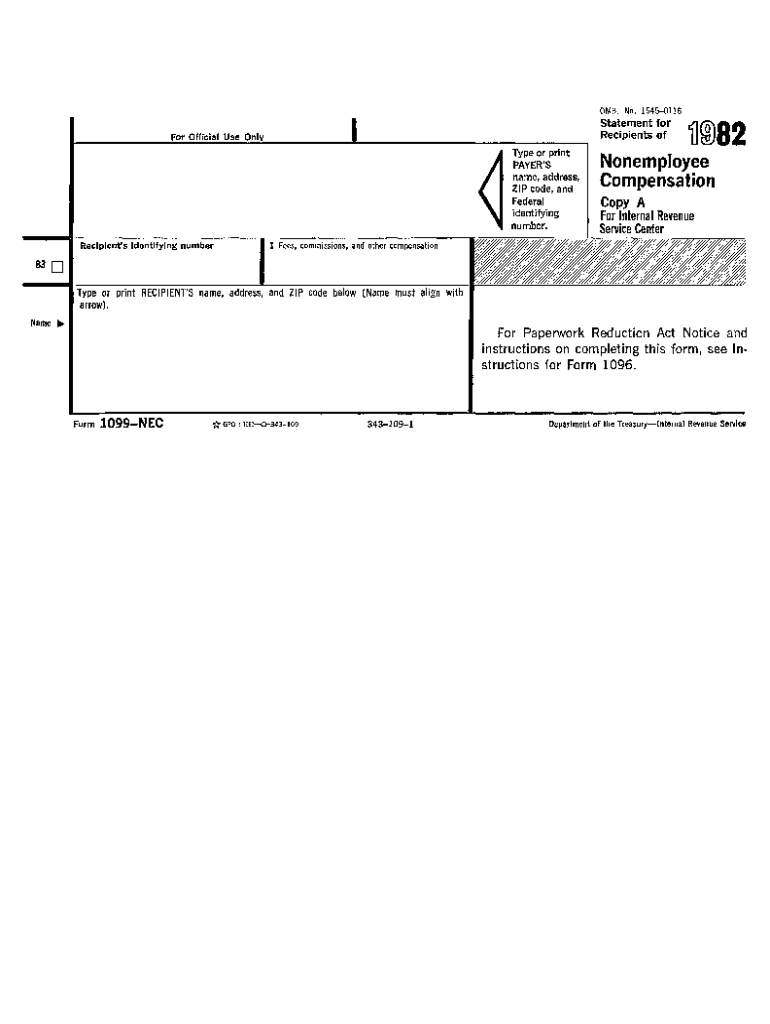

What the 1099NEC Coming Back Means for your Business Chortek

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

1099NEC Recipient Copy B Cut Sheet HRdirect

Completing And Filing This Tax Form Is Easy.

Start Completing The Fillable Fields And Carefully Type In Required Information.

Specify The Date Range For The Forms, Then Select All Vendors You Wish To Print 1099S.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Related Post: