Printable 1099Nec

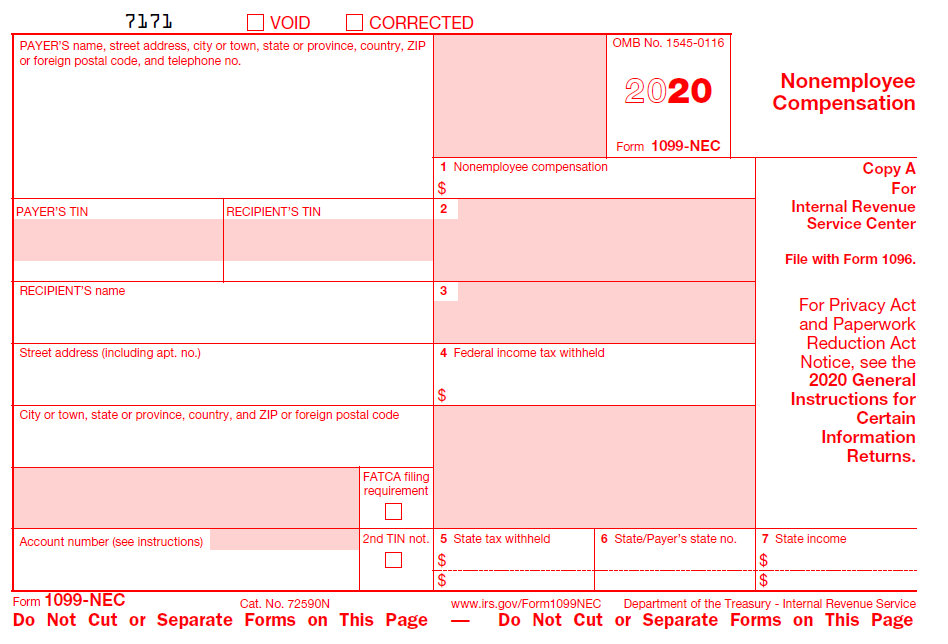

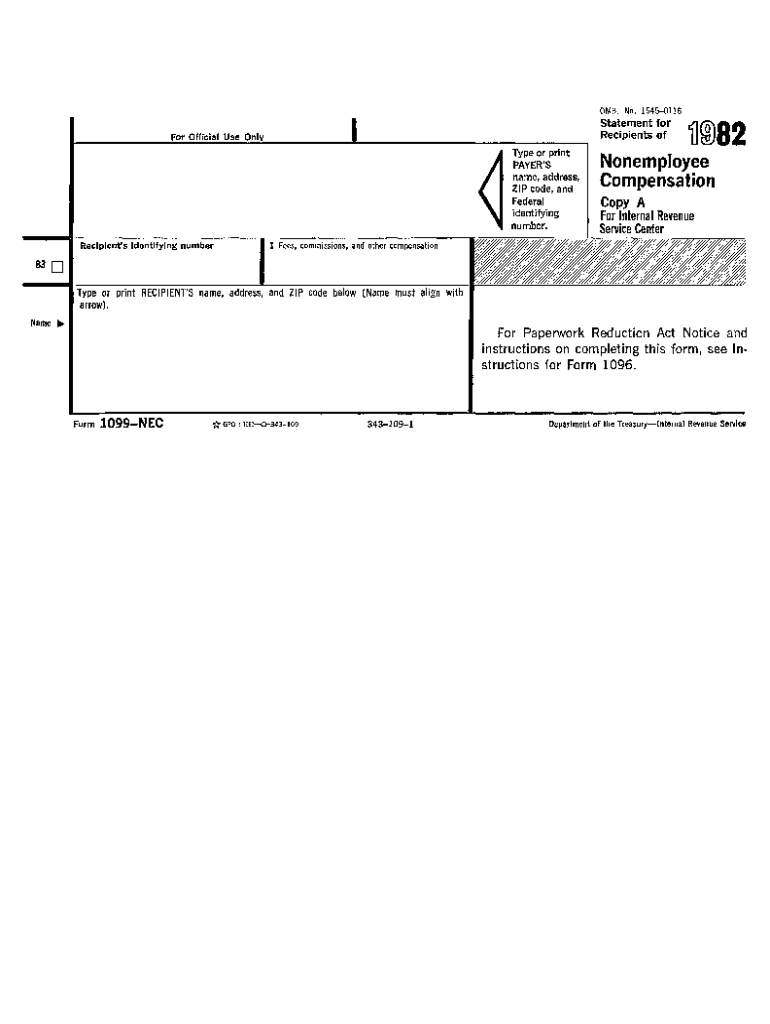

Printable 1099Nec - For internal revenue service center. Must be removed before printing. Fill in, efile, print, or download forms in pdf format. See part o in the current general. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Since you're unable to print the form with 3 part,. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Web the type and rule above prints on all proofs including departmental reproduction proofs. Additional instructions and information can be found on page 5 of the document;. Web the 1099 nec form is used to report nonemployee compensation, so if you have made payments to independent contractors or freelancers totaling $600 or more during the tax. Web the type and rule above prints on all proofs including departmental reproduction proofs. Actual and valid for filing 2023 taxes; Since you're unable to print the form with 3 part,. See part o in the current general. Download, print, efile, or save your work. For internal revenue service center. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Web the 1099 nec form is used to report nonemployee compensation, so if you have made payments to independent contractors or freelancers totaling $600 or more during the tax. Fill in, efile, print, or download forms in pdf format. Web print and file copy a downloaded from this website; Web print and file copy a downloaded from this website; Download, print, efile, or save your work. Since you're unable to print the form with 3 part,. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Must be removed before printing. Additional instructions and information can be found on page 5 of the document;. See part o in the current general. Web the 1099 nec form is used to report nonemployee compensation, so if you have made payments to independent contractors or freelancers totaling $600 or more during the tax. Fill in, efile, print, or download forms in pdf format. For. See part o in the current general. For internal revenue service center. Fill in, efile, print, or download forms in pdf format. Actual and valid for filing 2023 taxes; Since you're unable to print the form with 3 part,. See part o in the current general. Download, print, efile, or save your work. Web the type and rule above prints on all proofs including departmental reproduction proofs. Click and type in each field to fill out your form. Web the 1099 nec form is used to report nonemployee compensation, so if you have made payments to independent contractors or. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Fill in, efile, print, or download forms in pdf format. For internal revenue service center. Web print and file copy a downloaded from this website; Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498. See part o in the current general. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Download, print, efile, or save your work. Since you're unable to print the form with 3 part,. Web the 1099 nec form is used to report nonemployee compensation, so if you have made payments to independent. Since you're unable to print the form with 3 part,. For internal revenue service center. Must be removed before printing. Web print and file copy a downloaded from this website; Web the type and rule above prints on all proofs including departmental reproduction proofs. For internal revenue service center. Web the type and rule above prints on all proofs including departmental reproduction proofs. Web the 1099 nec form is used to report nonemployee compensation, so if you have made payments to independent contractors or freelancers totaling $600 or more during the tax. Fill in, efile, print, or download forms in pdf format. Download, print,. Click and type in each field to fill out your form. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Fill in, efile, print, or download forms in pdf format. Actual and valid for filing 2023 taxes; For internal revenue service center. Fill in, efile, print, or download forms in pdf format. Download, print, efile, or save your work. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Additional instructions and information can be found on page 5 of the document;. Because paper forms are scanned during processing, you cannot file forms 1096, 1097,. For internal revenue service center. Download, print, efile, or save your work. Web the type and rule above prints on all proofs including departmental reproduction proofs. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Click and type in each field to fill out your form. Fill in, efile, print, or download forms in pdf format. See part o in the current general. Additional instructions and information can be found on page 5 of the document;. Must be removed before printing. Actual and valid for filing 2023 taxes; Since you're unable to print the form with 3 part,.TSP 2020 Form 1099R Statements Should Be Examined Carefully

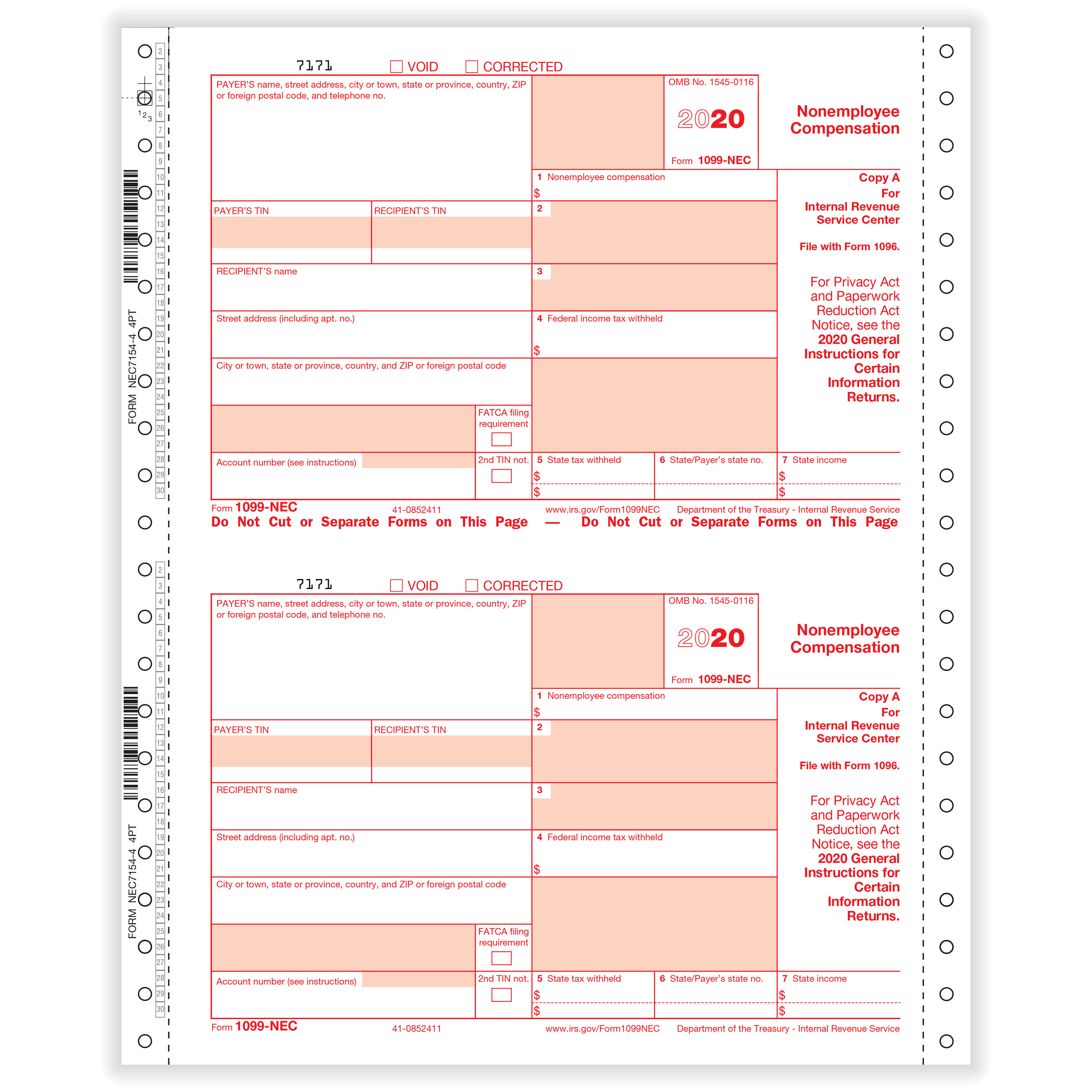

1099NEC Continuous 1" Wide 4Part Formstax

1099NEC Form Copy B/2 Discount Tax Forms

Printable Blank 1099 Nec Form Printable World Holiday

Accounts Payable Software for Small Business Accurate Tracking

How to File Your Taxes if You Received a Form 1099NEC

Form 1099NEC Instructions and Tax Reporting Guide

Blank 1099 Nec Fill and Sign Printable Template Online US Legal Forms

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

How To Fill Out A 1099 Nec Form By Hand Charles Leal's Template

Web Print And File Copy A Downloaded From This Website;

A Penalty May Be Imposed For Filing With The Irs Information Return Forms That Can’t Be Scanned.

Web The 1099 Nec Form Is Used To Report Nonemployee Compensation, So If You Have Made Payments To Independent Contractors Or Freelancers Totaling $600 Or More During The Tax.

Related Post: