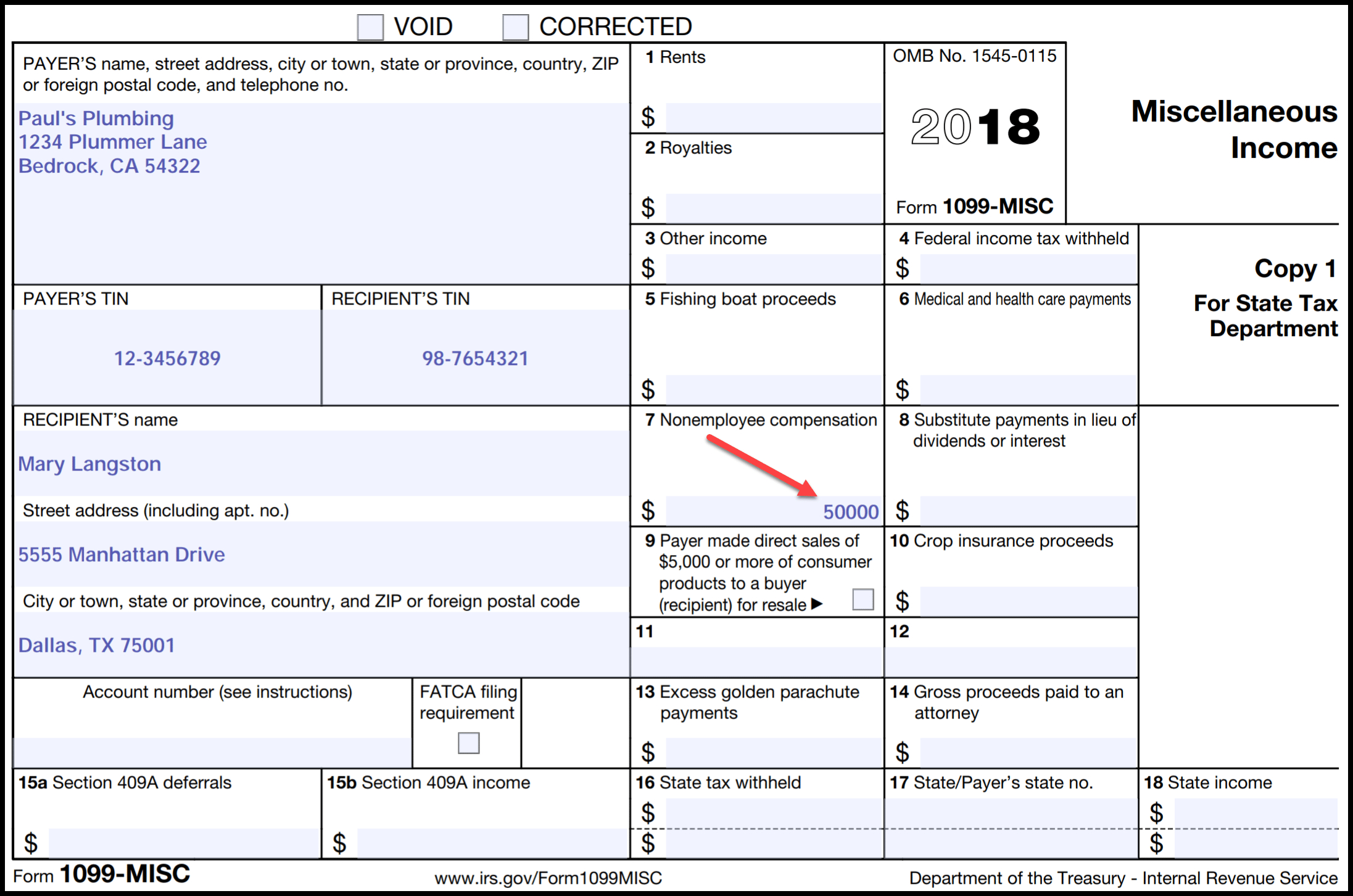

Printable 1099 Misc Tax Form Template

Printable 1099 Misc Tax Form Template - Use the cross or check marks in the top toolbar to select your answers in the list boxes. Pricing starts as low as $2.75/form. Signnow has paid close attention to ios users and developed an application just for them. Web 1099 misc 201919y create electronic signatures for signing a 2019 form 1099 misc iron in pdf format. Get printable version or file online These new “continuous use” forms no. Start completing the fillable fields and carefully type in required information. Quick & secure online filing. Download this 2022 excel template 2. Involved parties names, places of residence and phone numbers etc. Quick & secure online filing. To find it, go to the app store and type signnow in the search field. Signnow has paid close attention to ios users and developed an application just for them. Make small adjustments if needed 4. Download this 2022 excel template 2. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web 1099 misc 201919y create electronic signatures for signing a 2019 form 1099 misc iron in pdf format. Fill in the empty areas; Include the day/time and place your electronic signature. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. The form is easy to fill. Start completing the fillable fields and carefully type in required information. Print to your paper 1099 or 1096 forms several template options below: Visit to access the form online; A form to tell someone you’ll be sending them more forms? The irs has required clearly on how to report the information of the recipient on the 1099. Customize the template with exclusive fillable fields. But it actually helps the irs see if it’s gotten all the information returns it was supposed to. Print to your paper 1099 or 1096 forms several template options below: Web to calculate and print to. A form to tell someone you’ll be sending them more forms? The irs has required clearly on how to report the information of the recipient on the 1099. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Use get form or simply click on the template preview to open it in the editor. Customize. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Use get form or simply click on the template preview to open it in the editor. Involved parties names, places of residence and phone numbers etc. The. Get printable version or file online Use the cross or check marks in the top toolbar to select your answers in the list boxes. The form is easy to fill. Signnow has paid close attention to ios users and developed an application just for them. Web to calculate and print to irs 1099 forms with their unconventional spacing 1. Use get form or simply click on the template preview to open it in the editor. A form to tell someone you’ll be sending them more forms? The form is easy to fill. Customize the template with exclusive fillable fields. Pricing starts as low as $2.75/form. To find it, go to the app store and type signnow in the search field. Involved parties names, places of residence and phone numbers etc. Or log onto irs.gov and enter 'misc.' the document will be emailed to you. Here are a few tips on filling the 1099 misc 2022. These new “continuous use” forms no. Or log onto irs.gov and enter 'misc.' the document will be emailed to you. The form is easy to fill. Include the day/time and place your electronic signature. Involved parties names, places of residence and phone numbers etc. Download this 2022 excel template 2. The irs has required clearly on how to report the information of the recipient on the 1099. These new “continuous use” forms no. Get printable version or file online To find it, go to the app store and type signnow in the search field. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web 1099 misc 201919y create electronic signatures for signing a 2019 form 1099 misc iron in pdf format. Visit to access the form online; Web this is the form you fill out to tell the irs how many 1099 forms you’ll be sending in. To find it, go to the app store and type signnow in the search field. Start. Involved parties names, places of residence and phone numbers etc. These new “continuous use” forms no. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Use get form or simply click on the template preview to open it in the editor. Pricing starts as low as $2.75/form. Web this is the form you fill out to tell the irs how many 1099 forms you’ll be sending in. The form is easy to fill. Make small adjustments if needed 4. Get printable version or file online Print to your paper 1099 or 1096 forms several template options below: Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Start completing the fillable fields and carefully type in required information. Visit to access the form online; Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web 1099 misc 201919y create electronic signatures for signing a 2019 form 1099 misc iron in pdf format. Customize the template with exclusive fillable fields.1099MISC Form Printable and Fillable PDF Template

Instructions for Form 1099MISC (2018) Internal Revenue Service

IRS 1099MISC 2009 Fill out Tax Template Online US Legal Forms

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Tax Terms Everyone Should Know JenkinsCPA

1099MISC Form Template Create and Fill Online

EFile 1099 File Form 1099 Online Form 1099 for 2020

Free Printable 1099 Misc Forms Free Printable

What is a 1099Misc Form? Financial Strategy Center

1099MISC Tax Basics

Or Log Onto Irs.gov And Enter 'Misc.' The Document Will Be Emailed To You.

You May Also Have A Filing Requirement.

Quick & Secure Online Filing.

File It With The Irs By February 28.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)