Printable 1099 Int

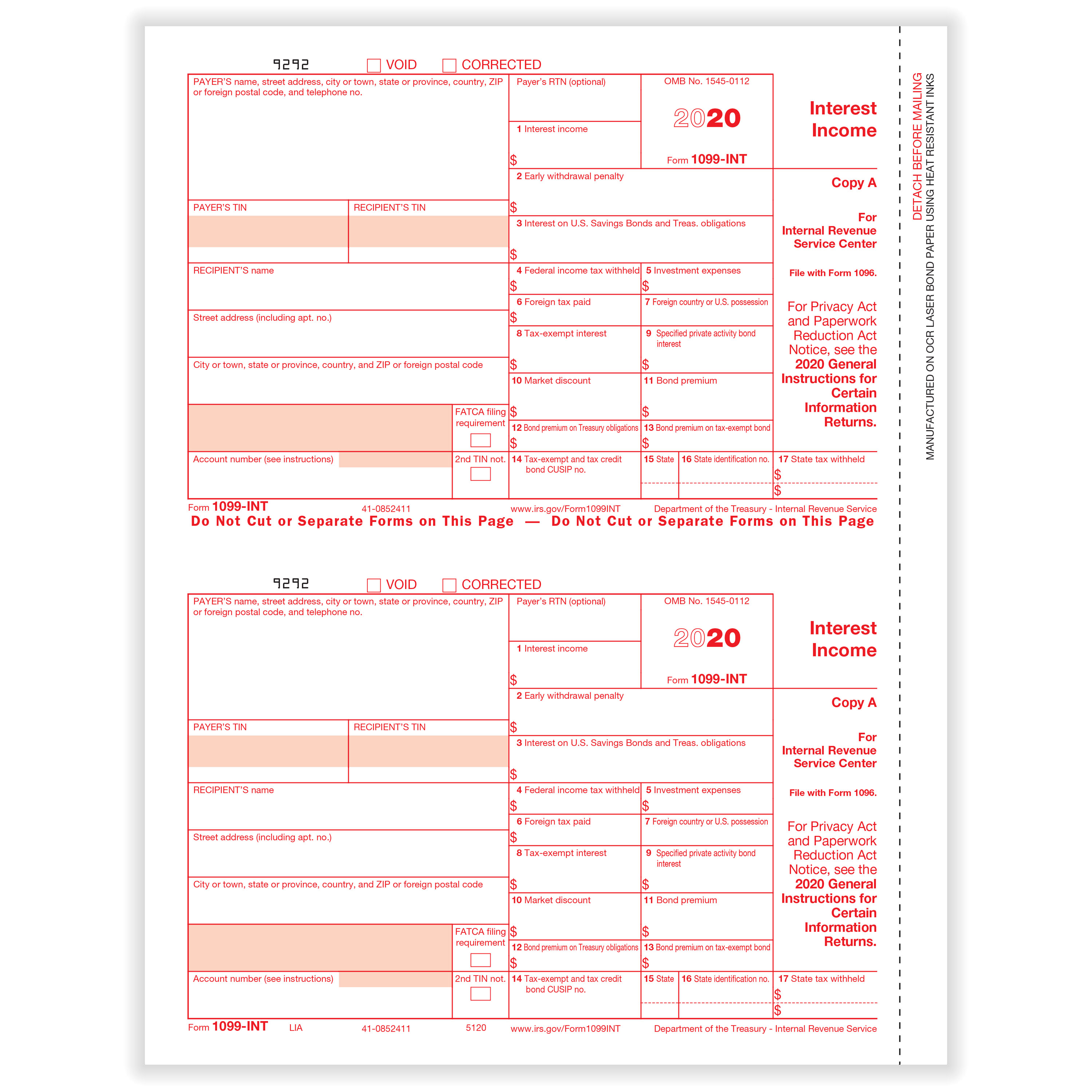

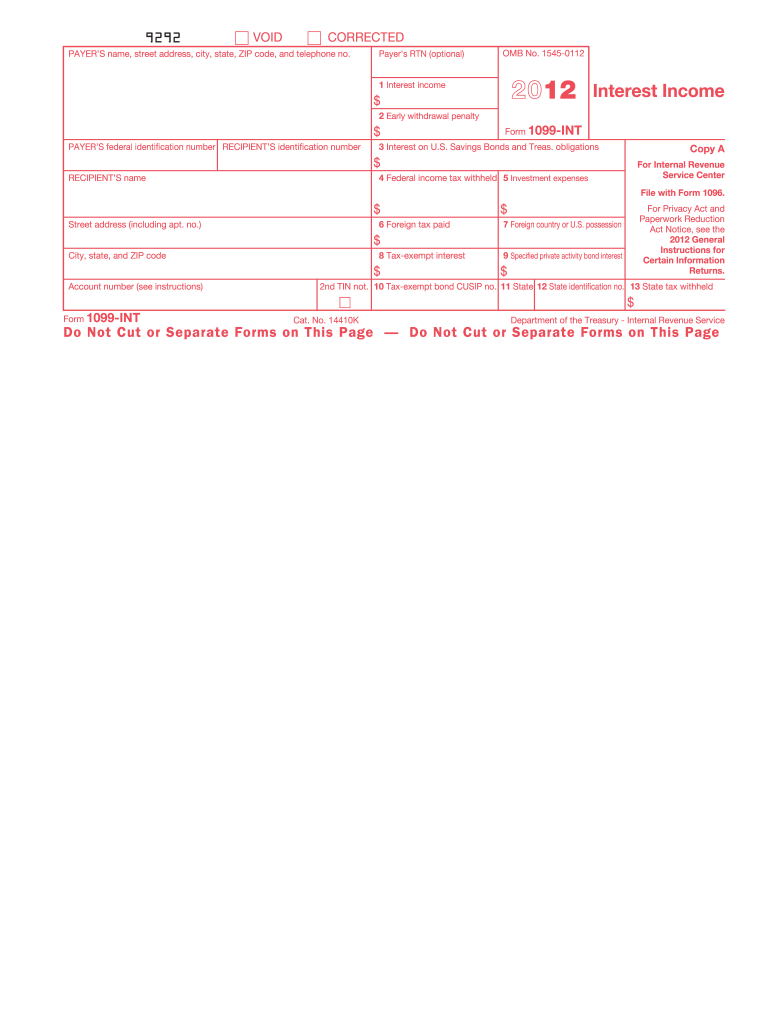

Printable 1099 Int - The following table provides information for each variant. It includes a breakdown of all types of interest income and related expenses. From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. See the instructions for your tax return. But you can't just download the pdf form and hit print to get a paper copy. Person that received at least $10 usd in interest during the calendar year. Place in your copier and copy onto the approved red irs 1096 (the irs only accepts preprinted red 1096 and will hit you with a penalty if you print on plain paper with red ink), then check the appropriate box. Payors to a customer who is a u.s. Inside w2 mate, examine the imported data. Make small adjustments if needed 4. Make small adjustments if needed 4. Savings bonds or treasury notes, bills or bonds. Blank 1099 forms and the related instructions can be downloaded from the irs website. Furnish copy b to each owner. If you earned more than $10 in interest from a bank, brokerage or other financial institution, you’ll. Payors to a customer who is a u.s. It includes a breakdown of all types of interest income and related expenses. File copy a of the form with the irs. The irs has very specific requirements about how to print 1099s. See the instructions for your tax return. Cut off bottom of page that includes the checkmark. The form details interest payments, related expenses, and taxes owed. But you can't just download the pdf form and hit print to get a paper copy. Blank 1099 forms and the related instructions can be downloaded from the irs website. From whom you withheld (and did not refund) any federal income. To calculate and print to irs 1099 forms with their unconventional spacing 1. Place in your copier and copy onto the approved red irs 1096 (the irs only accepts preprinted red 1096 and will hit you with a penalty if you print on plain paper with red ink), then check the appropriate box. Qualified plans and section 403(b) plans. It. Web to print the 1099 tax forms choose the icon, enter 1099 form boxes, and then choose the related link. From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. Print to your paper 1099 or 1096 forms several template options below: To whom you paid. From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. Cut off bottom of page that includes the checkmark. On the 1099 form boxes page, choose the reports action, and then choose one of vendor 1099 reports for printing: Furnish copy b to each owner. Payors. Print to your paper 1099 or 1096 forms several template options below: If you earned more than $10 in interest from a bank, brokerage or other financial institution, you’ll. The form is issued by all payers of interest income to investors at year end. Inside w2 mate, examine the imported data. Make sure the appropriate company is open in w2. On the 1099 form boxes page, choose the reports action, and then choose one of vendor 1099 reports for printing: Make small adjustments if needed 4. To calculate and print to irs 1099 forms with their unconventional spacing 1. Cut off bottom of page that includes the checkmark. Qualified plans and section 403(b) plans. The form details interest payments, related expenses, and taxes owed. Make sure the appropriate company is open in w2 mate. The form is issued by all payers of interest income to investors at year end. To calculate and print to irs 1099 forms with their unconventional spacing 1. If your annuity starting date is after 1997, you must use the. Savings bonds or treasury notes, bills or bonds. Blank 1099 forms and the related instructions can be downloaded from the irs website. Cut off bottom of page that includes the checkmark. See the instructions for your tax return. Cut off bottom of page that includes the checkmark. To calculate and print to irs 1099 forms with their unconventional spacing 1. Furnish copy b to each owner. On the 1099 form boxes page, choose the reports action, and then choose one of vendor 1099 reports for printing: From shortcuts, select “1098 & 1099 forms“. Payors to a customer who is a u.s. It includes a breakdown of all types of interest income and related expenses. The following table provides information for each variant. The form is issued by all payers of interest income to investors at year end. Internal revenue service (irs) and should be used by the individual customer when filing his or her annual income return. From whom you withheld. Qualified plans and section 403(b) plans. If your annuity starting date is after 1997, you must use the simplified method to figure your taxable amount if your payer didn’t show the taxable amount in box 2a. Box 3 reports interest earned on u.s. Box 2 reports interest penalties you were charged for withdrawing money from an account before the maturity date. Savings bonds or treasury notes, bills or bonds. The irs has very specific requirements about how to print 1099s. File copy a of the form with the irs. Furnish copy b to each owner. From whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. See the instructions for your tax return. It includes a breakdown of all types of interest income and related expenses. Print to your paper 1099 or 1096 forms several template options below: But you can't just download the pdf form and hit print to get a paper copy. On the 1099 form boxes page, choose the reports action, and then choose one of vendor 1099 reports for printing: Internal revenue service (irs) and should be used by the individual customer when filing his or her annual income return. Cut off bottom of page that includes the checkmark.Fillable IRS Form 1099 int 2018 2019 Online PDF Template

1099 Int Federal Form 1099INT Formstax

Sample of completed 1099int 205361How to calculate 1099int

Form 1099INT, IRS Copy A

Irs Form 1099 Contract Labor Form Resume Examples

Form 1099INT, IRS Copy A

Form 1099 Int Rev 10 2013 Fill Out and Sign Printable PDF Template

Printable Irs Form 1099 Int Universal Network

1099 Int Form Bank Of America Universal Network

Form 1099INT Interest Definition

From Shortcuts, Select “1098 & 1099 Forms“.

Blank 1099 Forms And The Related Instructions Can Be Downloaded From The Irs Website.

For Whom You Withheld And Paid Any Foreign Tax On Interest.

Place In Your Copier And Copy Onto The Approved Red Irs 1096 (The Irs Only Accepts Preprinted Red 1096 And Will Hit You With A Penalty If You Print On Plain Paper With Red Ink), Then Check The Appropriate Box.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)