Nc D-400V Printable Form

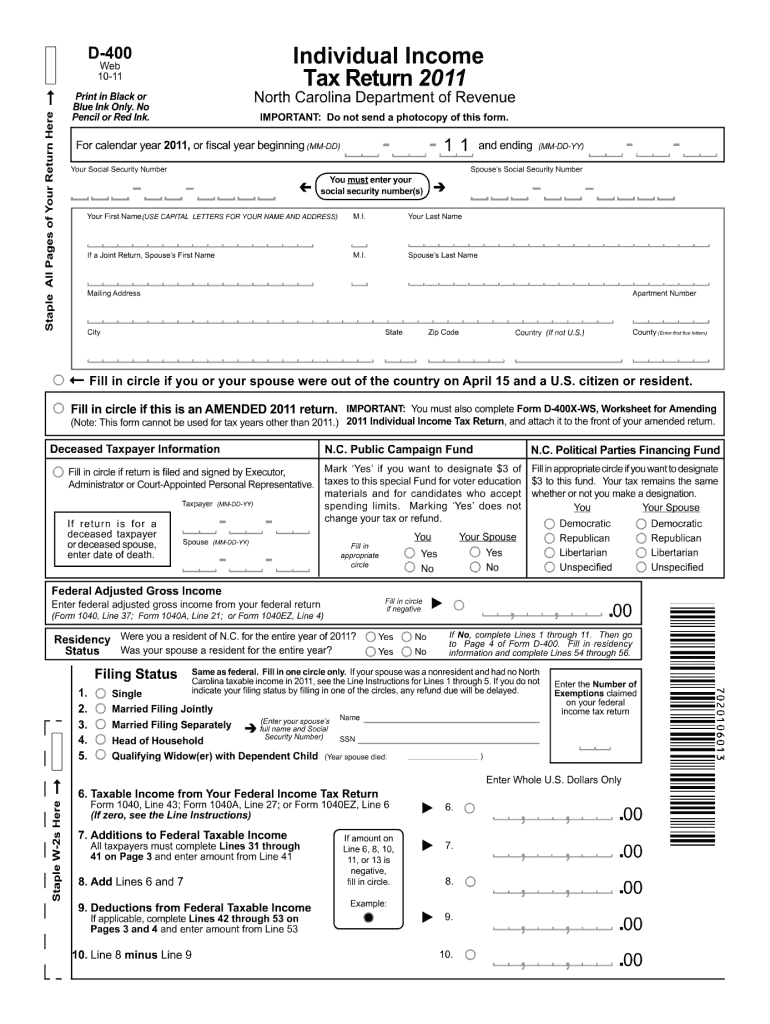

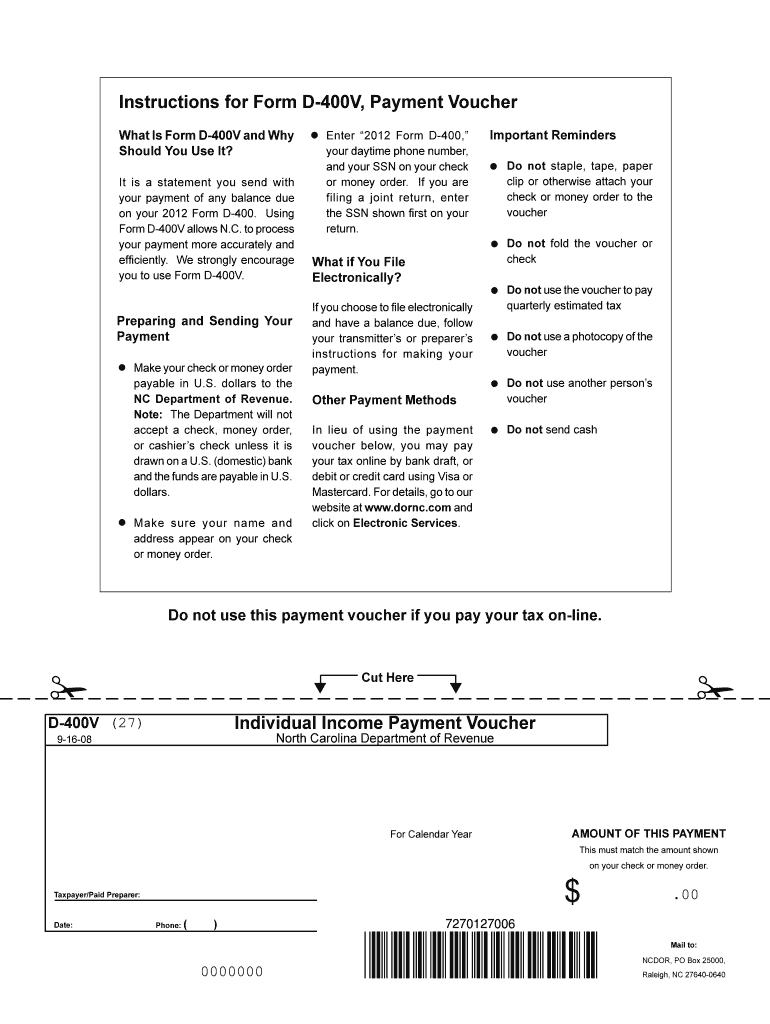

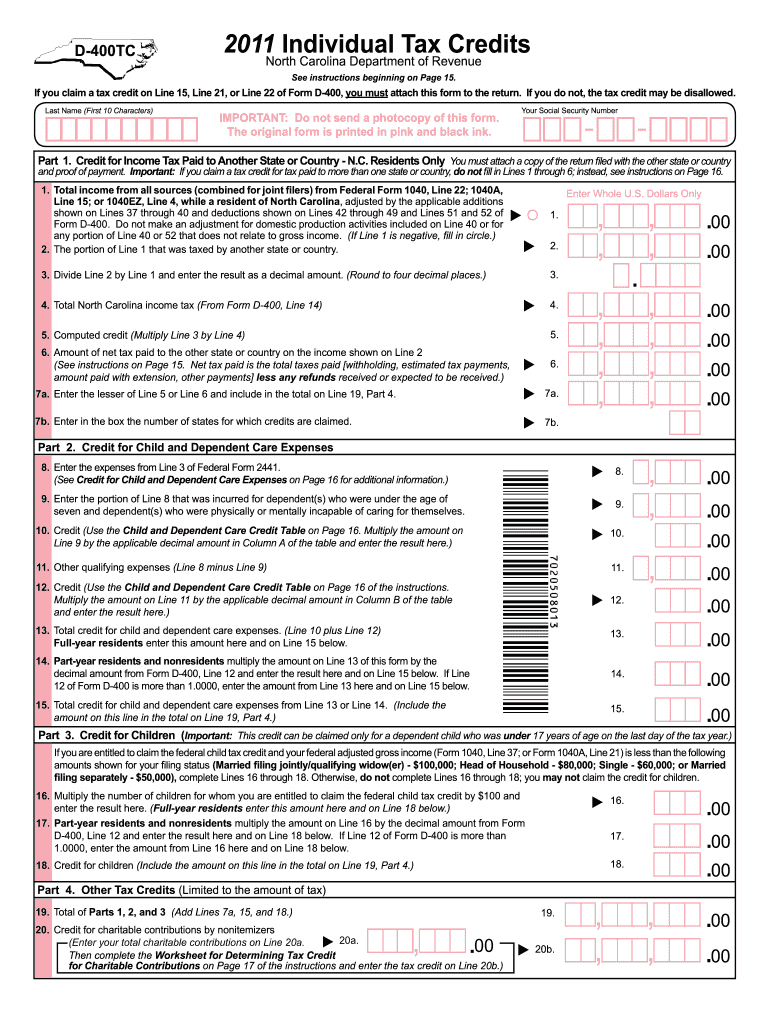

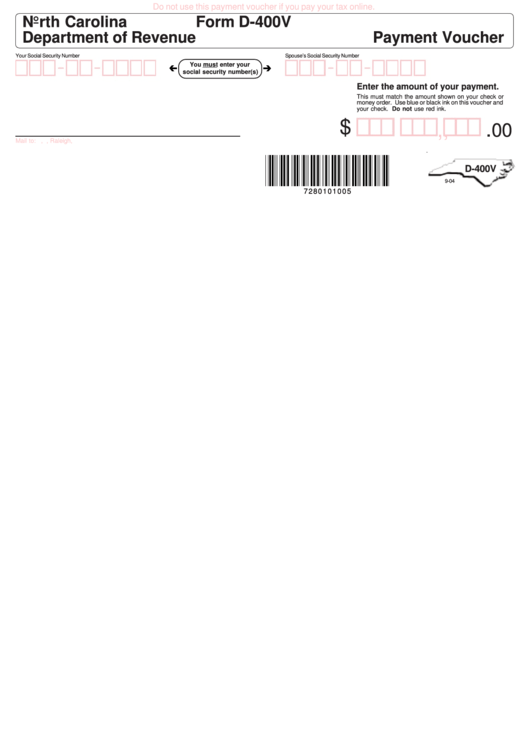

Nc D-400V Printable Form - Send filled & signed form or save. Web printable north carolina state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Ad iluvenglish.com has been visited by 10k+ users in the past month Ad freetaxusa.com has been visited by 10k+ users in the past month If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Do not send a photocopy of this form. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Single married filing joint married. Now you are on the file editing page. Web do not print this page. Ad freetaxusa.com has been visited by 10k+ users in the past month Easily sign the form with your finger. Use the create form button located below to generate the printable form. 2020 individual income tax return. Were you a resident of n.c. ★ ★ ★ ★ ★. Send filled & signed form or save. Ad iluvenglish.com has been visited by 10k+ users in the past month If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Ad freetaxusa.com has been visited by 10k+ users in the past month ★ ★ ★ ★ ★. The department will not accept a check, money order, or cashier’s check unless it is drawn on a u.s. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Were you a resident of n.c. Open the d400v and follow the instructions. Use the create form button located below to generate the printable form. Web get started with a nc d 400v printable form 2008, complete it in a few clicks, and submit it securely. Easily sign the form with your finger. The department will not accept a check, money order, or cashier’s check unless. 2020 individual income tax return. Web get started with a nc d 400v printable form 2008, complete it in a few clicks, and submit it securely. Print in black or blue ink. Ad iluvenglish.com has been visited by 10k+ users in the past month If the form does not appear after you click create form. Print in black or blue ink. Click the orange button get form here on the webpage. Ad iluvenglish.com has been visited by 10k+ users in the past month Use the create form button located below to generate the printable form. Now you are on the file editing page. Print in black or blue ink. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Easily sign the form with your finger. Single married filing joint married. Open the d400v and follow the instructions. Use the create form button located below to generate the printable form. Do not send a photocopy of this form. Ad iluvenglish.com has been visited by 10k+ users in the past month Fill in circle if you or, if married filing jointly, your spouse were out of the country on. ★ ★ ★ ★ ★. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Print in black or blue ink. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. 2020 individual income tax return. Pay a balance due on your individual income tax return for the current. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Now you are on the file editing page. Send filled & signed form or save. The department will not accept a check, money order, or cashier’s check unless it is drawn on a u.s. Web get started with a nc d. Were you a resident of n.c. 2020 individual income tax return. Single married filing joint married. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Click the orange button get form here on the webpage. You can edit, add text, highlight specific words or phrases, put. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Single married filing joint married. Send filled & signed form or save. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. The department will not accept a check, money order, or cashier’s check unless it is drawn on a u.s. ★ ★ ★ ★ ★. Open the d400v and follow the instructions. Were you a resident of n.c. Send filled & signed form or save. Use the create form button located below to generate the printable form. Were you a resident of n.c. Now you are on the file editing page. 2020 individual income tax return. Do not send a photocopy of this form. Ad freetaxusa.com has been visited by 10k+ users in the past month Ad iluvenglish.com has been visited by 10k+ users in the past month Web do not print this page. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. This payment application should be used only for the payment of tax owed on an amended north carolina individual.NC DoR D400 2011 Fill out Tax Template Online US Legal Forms

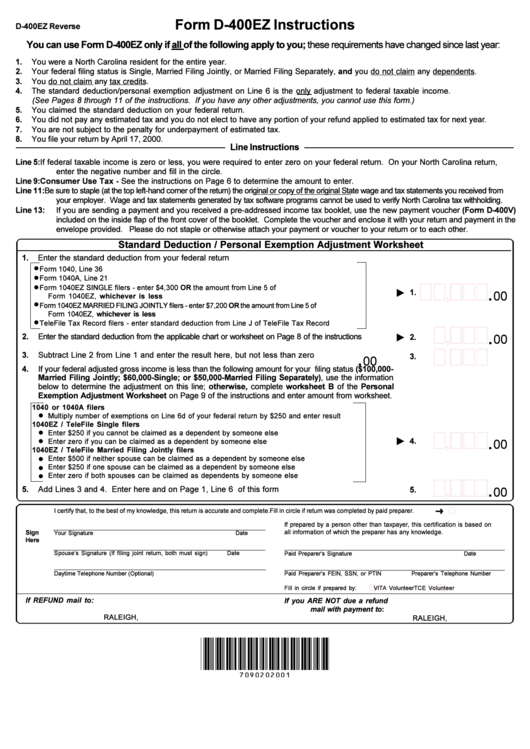

Form D400ez Instructions North Carolina Department Of Revenue

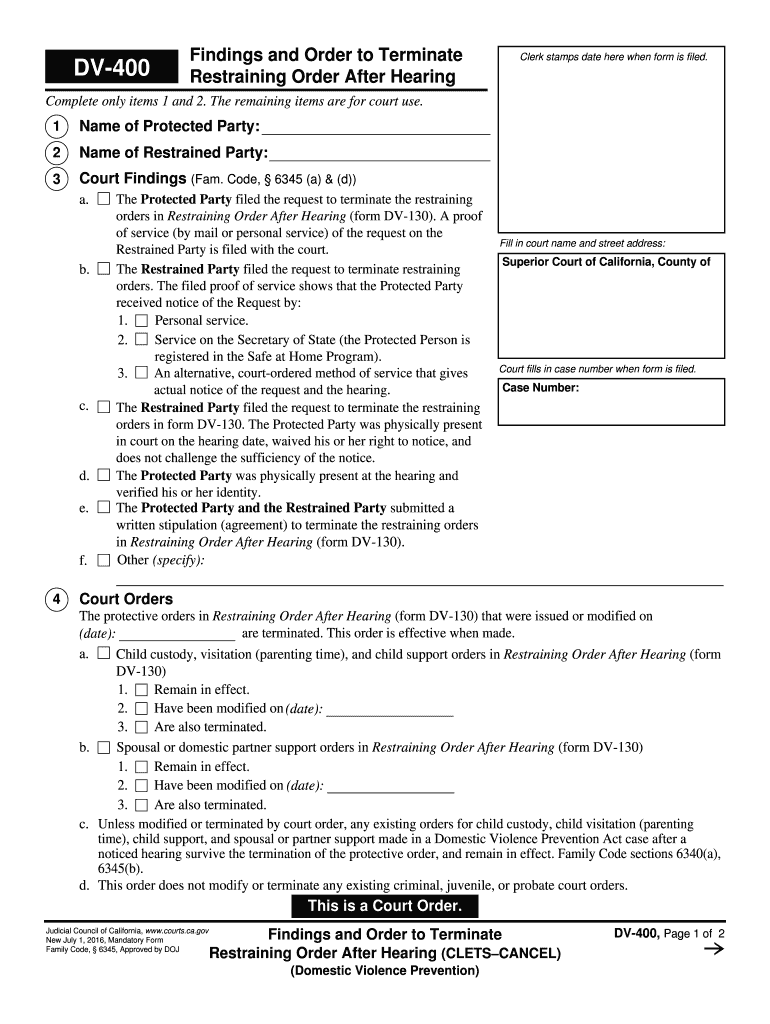

Dv 400 Form Fill Out and Sign Printable PDF Template signNow

2006 Form NC DoR D400Fill Online, Printable, Fillable, Blank pdfFiller

2013 north carolina_return sylvia_jarrell

Nc D 400v Printable Form Fill Online, Printable, Fillable, Blank

NC DoR D400XWS 2010 Fill out Tax Template Online US Legal Forms

Nc Form D 400v Printable Printable Forms Free Online

Ncd400 Instructions Fill Out and Sign Printable PDF Template signNow

Form D400v Payment Voucher North Carolina Department Of Revenue

Web Get Started With A Nc D 400V Printable Form 2008, Complete It In A Few Clicks, And Submit It Securely.

Easily Sign The Form With Your Finger.

Open Form Follow The Instructions.

Click The Orange Button Get Form Here On The Webpage.

Related Post: