Irs Gov 1099 Printable Form

Irs Gov 1099 Printable Form - Fill, edit, sign, download & print. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Sign in to your account if you didn't get a tax form in the mail. Web loans treated as distributions. Free guide on how to use 1099 forms for your taxes. Web loans treated as distributions. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Download your adjusted document, export it to the cloud, print it from the editor, or share it with others through a shareable link or as an. Web get the printable 1099 form completed. Complete irs tax forms online or print government tax documents. Web loans treated as distributions. Do not miss the deadline Complete irs tax forms online or print government tax documents. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Fill, edit, sign, download & print. Web loans treated as distributions. Sign in to your account if you didn't get a tax form in the mail. Ad get the latest 1099 misc online. Ad fill out your information to learn how to download your 1099 tax form. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Ad access irs tax forms. Web loans treated as distributions.. Web loans treated as distributions. Download your adjusted document, export it to the cloud, print it from the editor, or share it with others through a shareable link or as an. Web loans treated as distributions. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web loans treated as distributions. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Ad get the latest 1099 misc online. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Sign in to your account if you didn't get a tax form in the mail. Web loans treated as distributions. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b). Web loans treated as distributions. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Ad access irs tax forms. Ad fill out your information to learn how to download your 1099 tax form. Complete, edit or print tax forms instantly. Ad access irs tax forms. Fill, edit, sign, download & print. Complete, edit or print tax forms instantly. Web loans treated as distributions. Ad get the latest 1099 misc online. Sign in to your account if you didn't get a tax form in the mail. Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Download your adjusted document, export it to the cloud, print it from the editor, or share it with others through a shareable link or as an. Web loans. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Web loans treated as distributions. Complete irs tax forms online or print government tax documents. Web loans treated as distributions. Web get the current filing year’s forms, instructions, and publications for free from the internal. Complete irs tax forms online or print government tax documents. Fill, edit, sign, download & print. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Complete, edit or print tax forms instantly. Ad fill out your information to learn how to download your 1099 tax form. Ad get the latest 1099 misc online. Web loans treated as distributions. Free guide on how to use 1099 forms for your taxes. If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Do not miss the deadline Download your adjusted document, export it to the cloud, print it from the editor, or share it with others through a shareable link or as an. Sign in to your account if you didn't get a tax form in the mail. Web get the current filing year’s forms, instructions, and publications for free from the internal revenue service (irs). Do not miss the deadline If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a. Web get the printable 1099 form completed. Web loans treated as distributions. Free guide on how to use 1099 forms for your taxes. Fill, edit, sign, download & print. Complete irs tax forms online or print government tax documents. Web loans treated as distributions. Ad get the latest 1099 misc online. Complete, edit or print tax forms instantly.EFile 1099R 2021 Form 1099R Online How to File 1099R

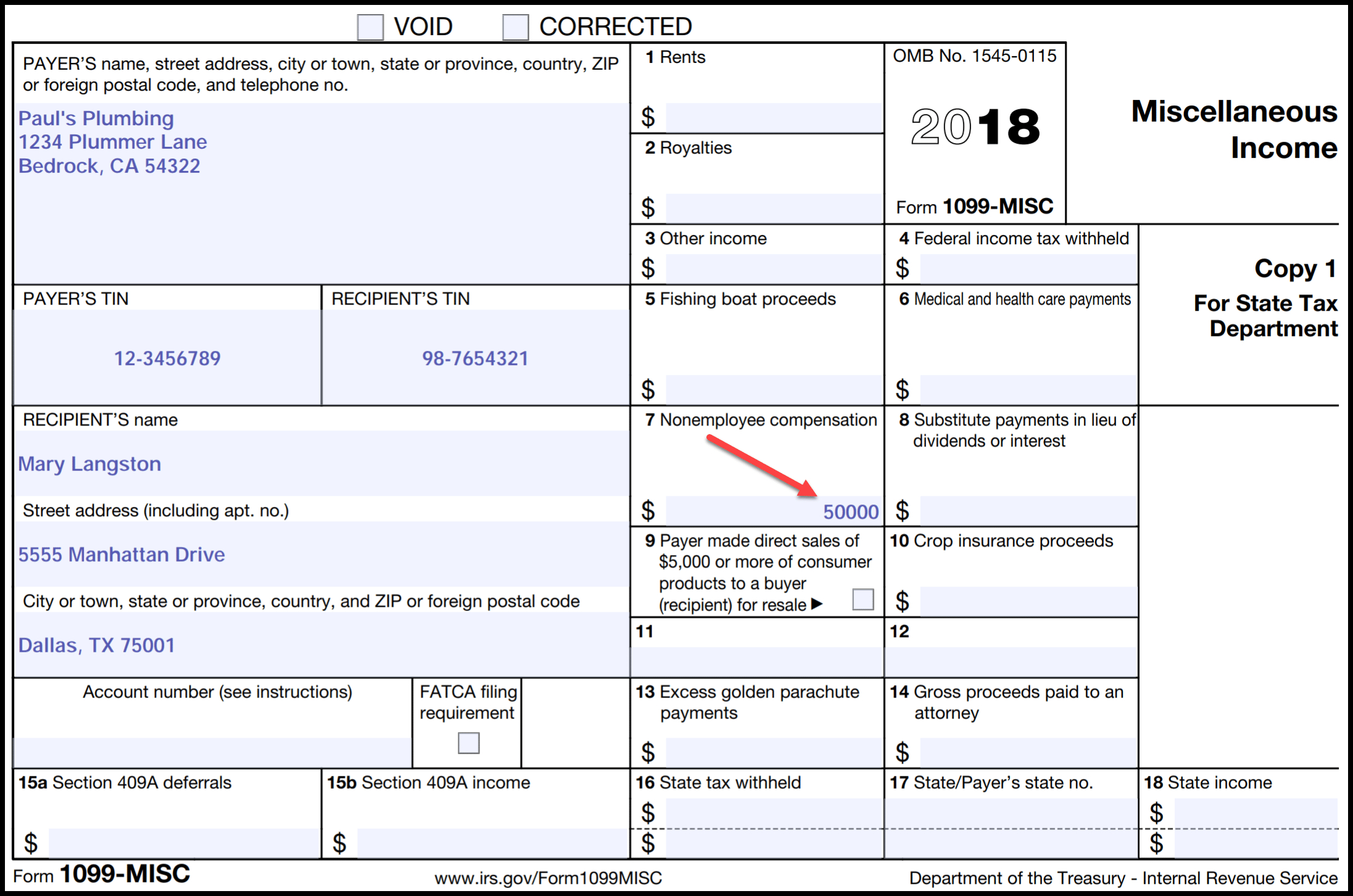

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

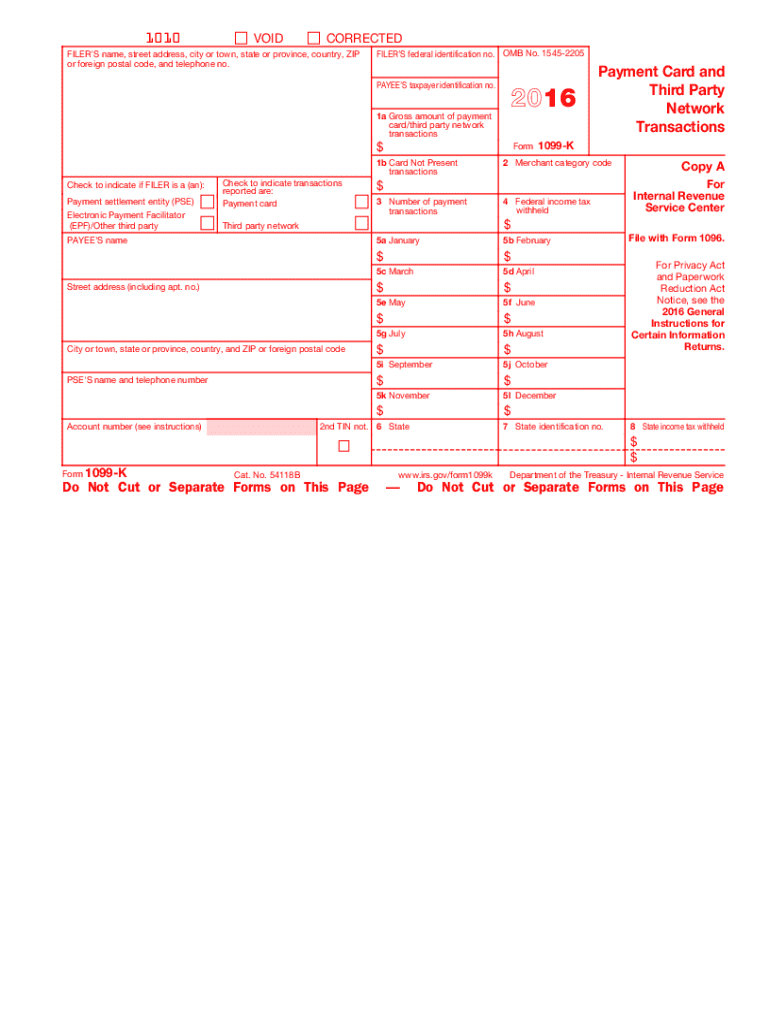

IRS 1099K 2016 Fill out Tax Template Online US Legal Forms

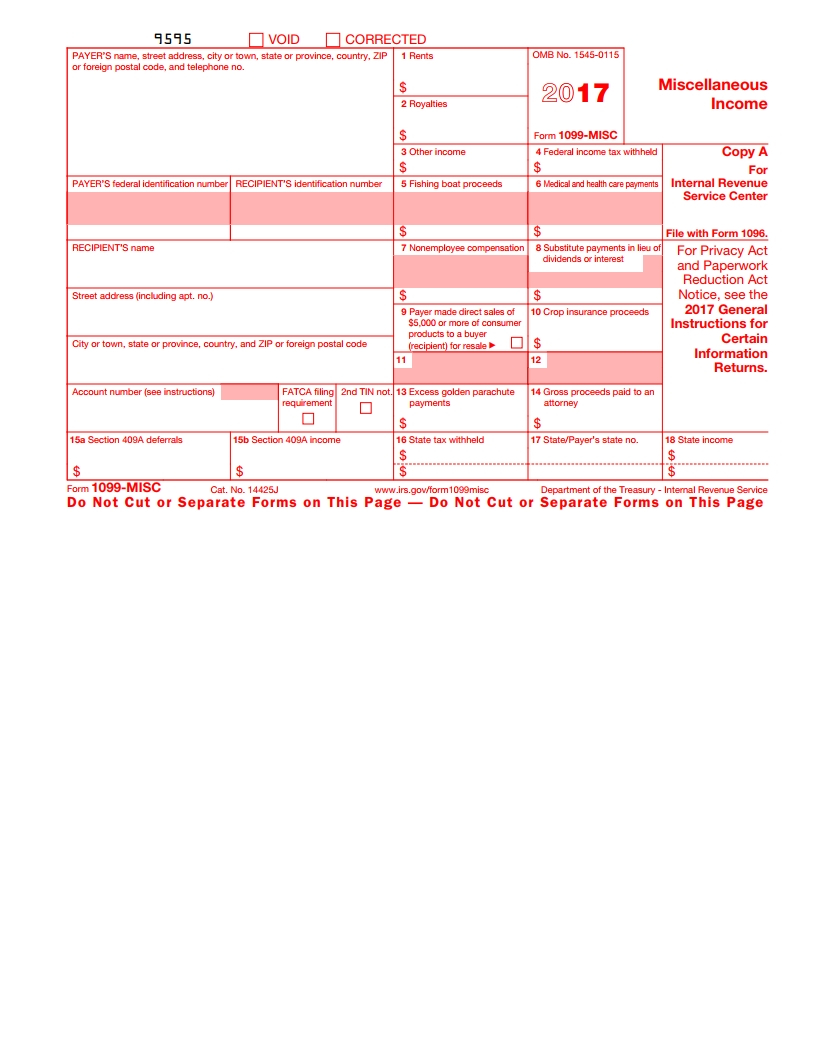

Printable 1099 Form 2017 Irs.gov Universal Network

Irs 12 Form 12 Printable Free Papers And Forms Blank 1099 Misc

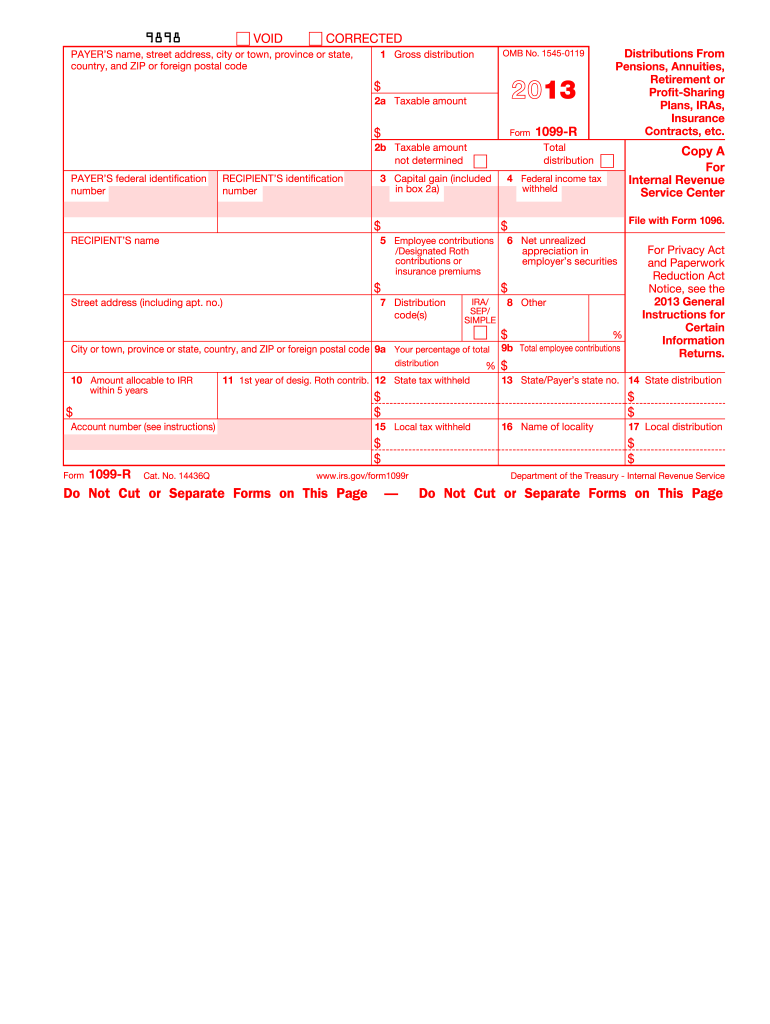

Do You Get A 1099 R For A Rollover Armando Friend's Template

2013 Form IRS 1099R Fill Online, Printable, Fillable, Blank PDFfiller

Free Printable 1099 Forms Irs.gov Form Resume Examples jNDAQYLD6x

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

1099 Misc Fillable Form Free amulette

If You Borrow Money From A Qualified Plan, Section 403(B) Plan, Or Governmental Section 457(B) Plan, You May Have To Treat The Loan As A.

Ad Fill Out Your Information To Learn How To Download Your 1099 Tax Form.

Web Download A Copy Of Your 1099 Or 1042S Tax Form So You Can Report Your Social Security Income On Your Tax Return.

Ad Access Irs Tax Forms.

Related Post: