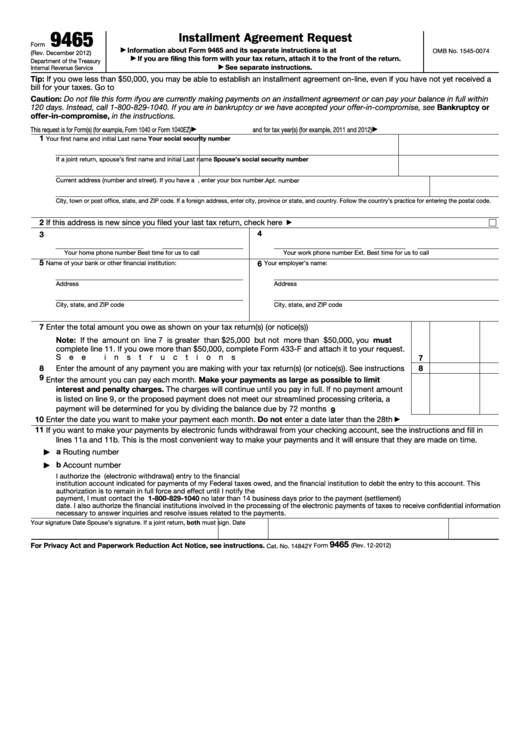

Irs Form 9465 Printable

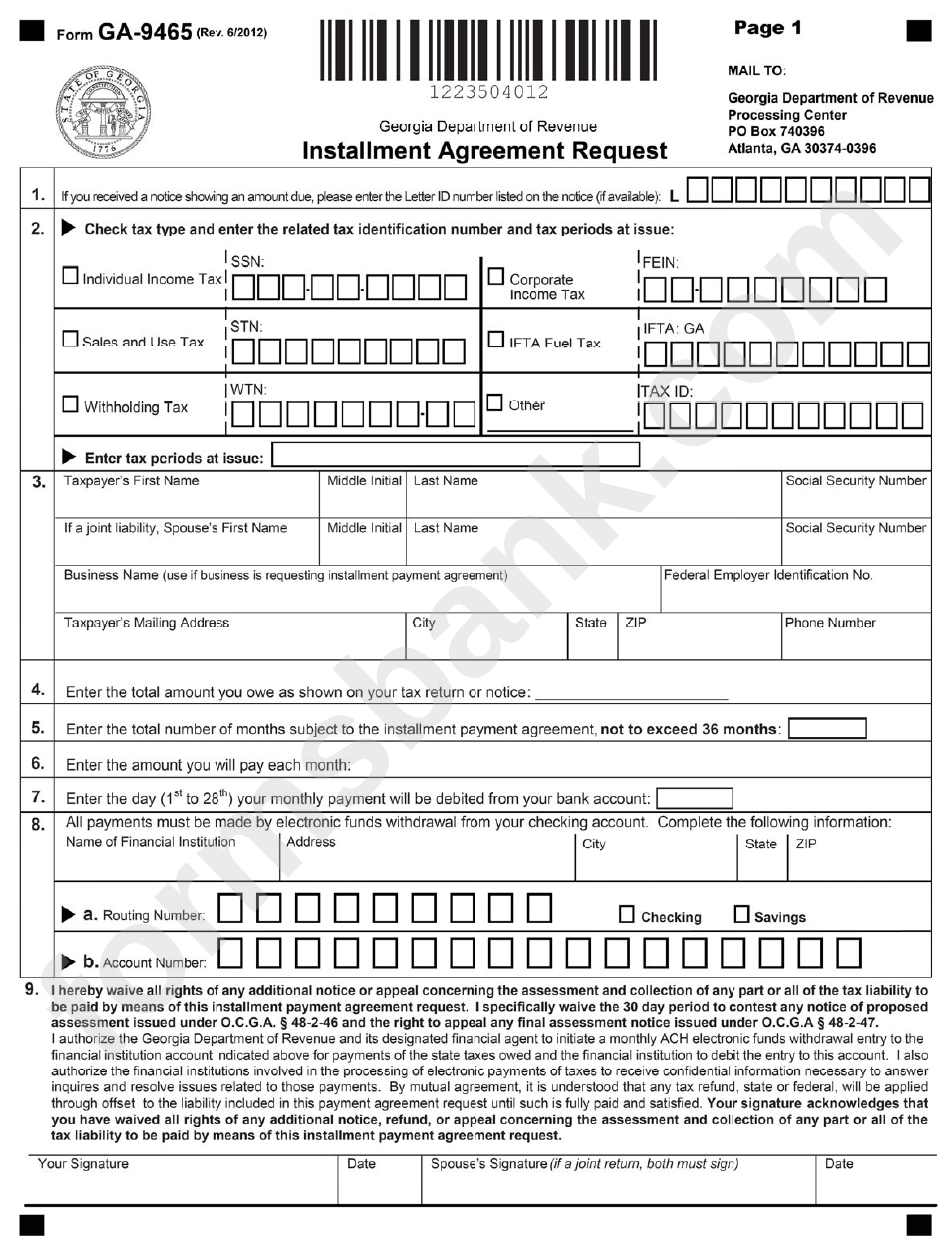

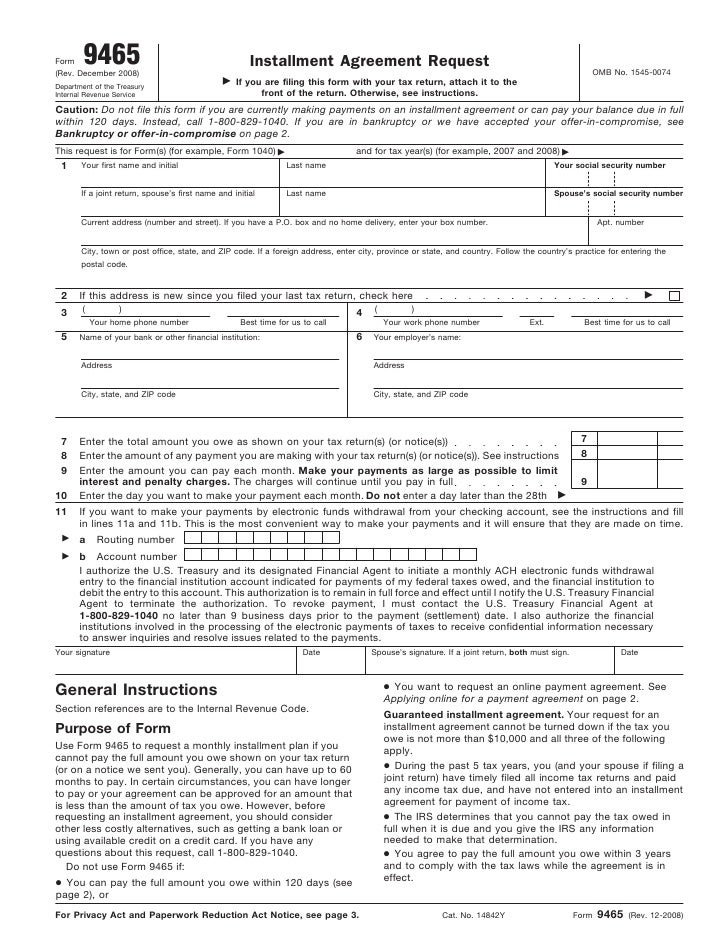

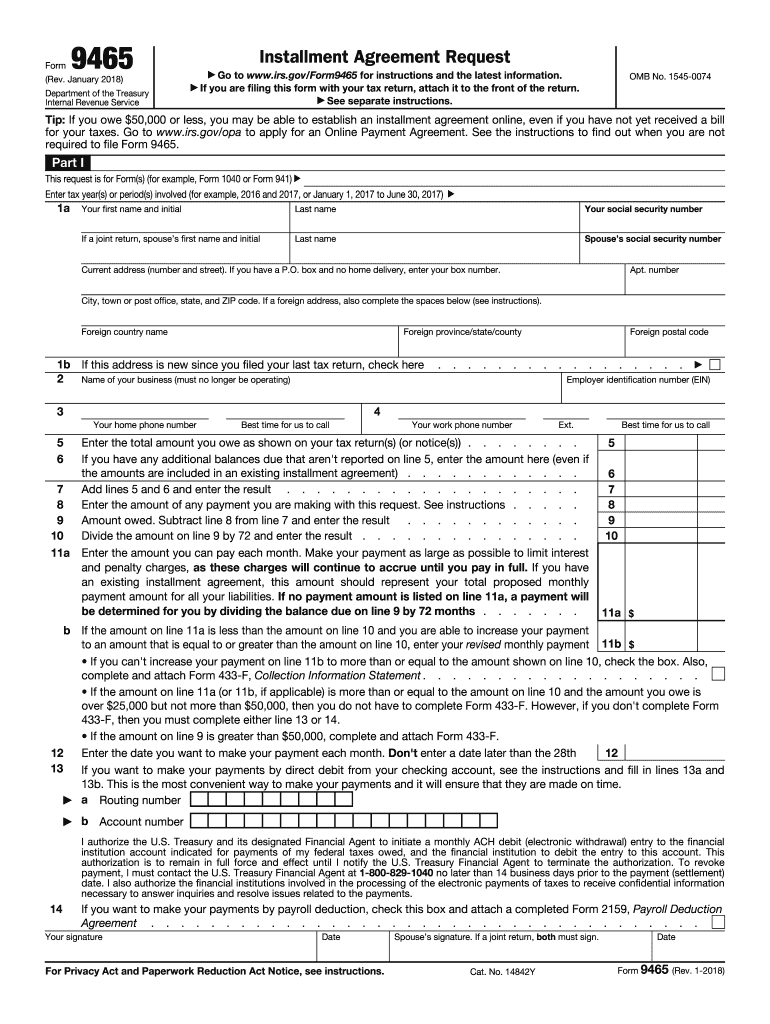

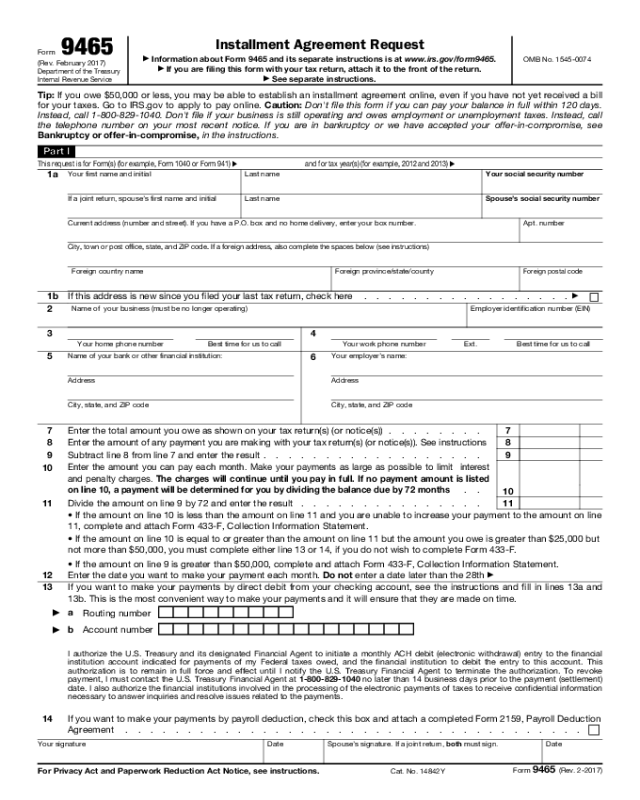

Irs Form 9465 Printable - Download this form print this form Web form 9465 is a document you can file to formally request a monthly installment payment plan in the event you cannot pay what you owe from your federal tax return. You can file form 9465 by itself, even if. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. Then, mail the form to the irs. If the amount you owe on line 9 is greater than $50,000, you cannot file form 9465 electronically. Most installment agreements meet our streamlined installment agreement criteria. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. More about the federal form 9465 efile your federal tax return now In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. You can file form 9465 by itself, even if. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web federal income tax forms federal form 9465 federal installment agreement request form 9465 pdf form content report error it appears you don't have a pdf plugin for this browser. If the amount you owe on line 9 is greater than $50,000, you cannot file form 9465 electronically. Then, mail the form to the irs. Subtract line 8 from line 7 and enter the result. Do not file this form if you are currently making payments on an installment agreement or can pay your balance in full within 120 days. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your return. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your return. More about the federal form 9465. Web internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. Web form 9465 is a document you can file to formally request a monthly installment payment plan in the event you cannot pay what you owe from your federal tax return. Do not file this. In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Use form 9465 to request a monthly installment plan. You can file form 9465 by itself, even if. Download this form print this form 1 your first name and initial last. Form 9465 is available in all versions of taxact ®. Web internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. 1 your first name and initial last. In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. If the amount you owe on line 9 is greater than $50,000, you cannot file form 9465 electronically. Web use irs form 9465 installment agreement. Web internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. Web federal income tax forms federal form 9465 federal installment agreement request form 9465 pdf form content report error it appears you don't have a pdf plugin for this browser. Web form 9465 is a. Download this form print this form In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Do not file this. Web form 9465 is a document you can file to formally request a monthly installment payment plan in the event you cannot pay what you owe from your federal tax return. If the amount you owe on line 9 is greater than $50,000, you cannot file form 9465 electronically. Then, mail the form to the irs. You can file form. Subtract line 8 from line 7 and enter the result. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). In most cases, it is a good idea to pay a portion of your tax debt before asking for payment. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web federal income tax forms federal form 9465 federal installment agreement request form 9465 pdf form content report error it appears you don't have a pdf plugin for this browser. You can submit form 9465 on its. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your return. More about the federal form 9465 efile your federal tax return now Web form 9465 installment agreement request department of the treasury internal revenue service if you are filing this form with your tax return, attach it to the front of the return. Download this form print this form Form 9465 is available in all versions of taxact ®. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web form 9465 is a document you can file to formally request a monthly installment payment plan in the event you cannot pay what you owe from your federal tax return. Do not file this form if you are currently making payments on an installment agreement or can pay your balance in full within 120 days. 1 your first name and initial last. Web form 9465 federal — installment agreement request download this form print this form it appears you don't have a pdf plugin for this browser. Most installment agreements meet our streamlined installment agreement criteria. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Then, mail the form to the irs. The maximum term for a streamlined agreement is 72 months. Web to file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand.Form Ga9465 Installment Agreement Request printable pdf download

Irs Form 9465 Fillable and Editable PDF Template

Form 9465Installment Agreement Request

IRS 9465 2018 Fill out Tax Template Online US Legal Forms

Form 9465 Edit, Fill, Sign Online Handypdf

Fillable Form 9465 Installment Agreement Request printable pdf download

Form 9465. Installment Agreement Request Fill out & sign online DocHub

IRS 9465 Instructions 20202022 Fill out Tax Template Online US

IRS Form 9465 Instructions for How to Fill it Correctly

How Do I Set Up an Installment Agreement; IRS Just Sent Me Form 9465

Web Internal Revenue Service Installment Agreement Request If You Are Filing This Form With Your Tax Return, Attach It To The Front Of The Return.

If The Amount You Owe On Line 9 Is Greater Than $50,000, You Cannot File Form 9465 Electronically.

Web Federal Income Tax Forms Federal Form 9465 Federal Installment Agreement Request Form 9465 Pdf Form Content Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

In Most Cases, It Is A Good Idea To Pay A Portion Of Your Tax Debt Before Asking For Payment Assistance From The Irs For The Leftover Balance.

Related Post: