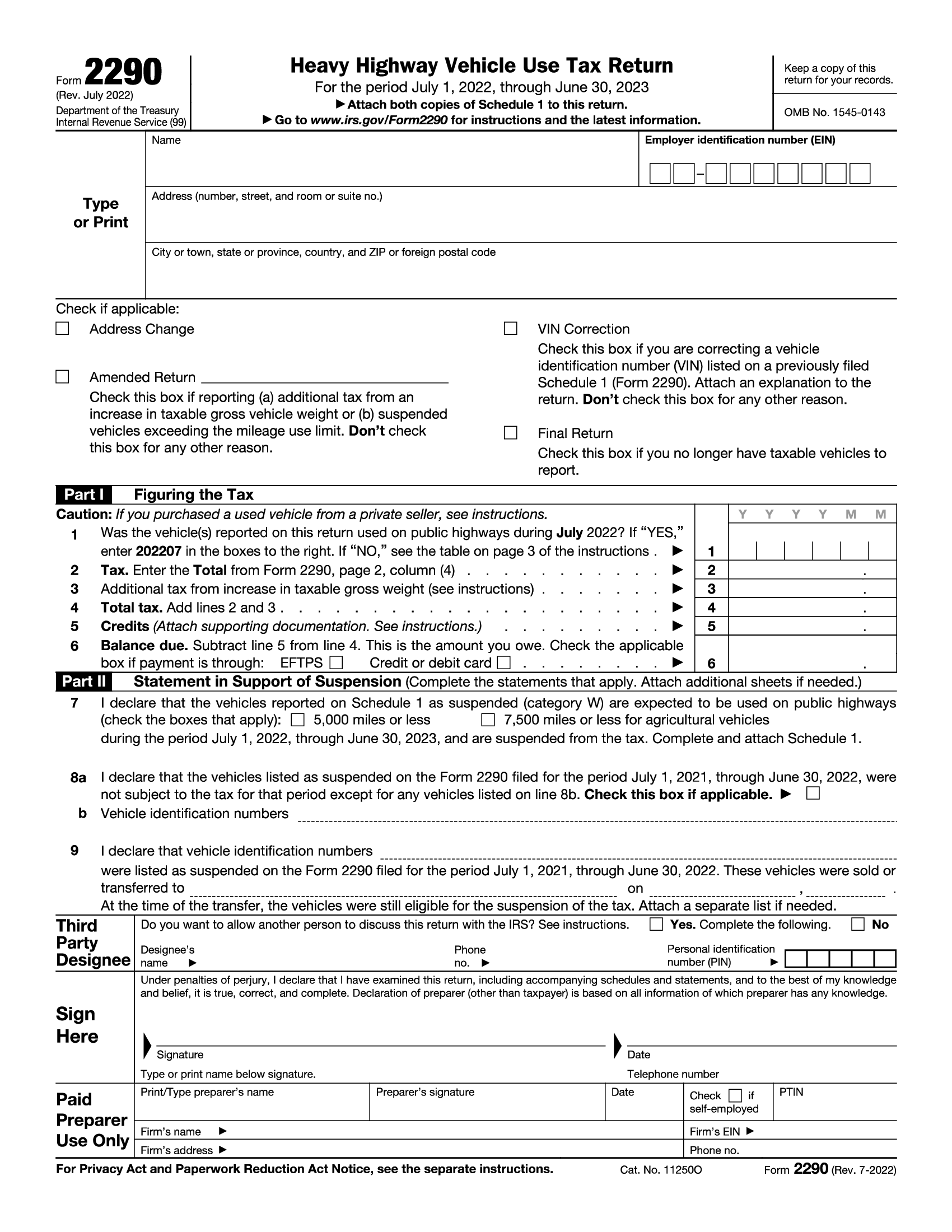

Form 2290 Printable

Form 2290 Printable - Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period. Web form 2290 must be filed by the last day of the month followed by the month of the first use of the taxable vehicles. Web you must file this form 2290 (rev. Claim suspension from the tax when a vehicle is expected to be used 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period; Web discover comprehensive form 2290 instructions for filing your heavy vehicle use tax with ease. Web form 2290 is a crucial requirement for owners and operators of heavy vehicles to fulfill their heavy highway vehicle use tax obligations. Web the form 2290 is a tax return that must be filed by anyone who owns or operates a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more that is used on a public highway. Complete both copies of schedule 1 (form 2290) and attach them to form 2290. This revision if you need to file a return for a tax period that began on or before june 30, 2019. The current period begins from july 1, 2024 to june 30, 2025. File your form 2290 online and get your stamped schedule 1 in minutes. Web figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases, and the vehicle falls into a new category; The form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. Web complete both copies of schedule 1 (form 2290) and attach them to form 2290. Web form 2290 must be filed by the last day of the month followed by the month of the first use of the taxable vehicles. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. The current period begins from july 1, 2024 to june 30, 2025. Web report suspended vehicles that are going to be driven less than 5,00 miles in the tax period. Web form 2290 is a crucial requirement for owners and operators of heavy vehicles to fulfill their heavy highway vehicle use tax obligations. Irs form 2290 is often used in truck tax, heavy highway vehicle use tax return, vehicle taxes, tax deadline, use tax, tax refund form, tax payment form, u.s. This revision if you need to file a return for a tax period that began on or before june 30, 2019. Browse 11 form 2290 templates collected for any of your needs. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor. Web simple & secure service for form 2290 online filing. File your form 2290 online and get your stamped schedule 1 in minutes. Web download form 2290 for current and previous years. The purpose of the tax is to help fund the. Web report suspended vehicles that are going to be driven less than 5,00 miles in the tax period. Complete both copies of schedule 1 (form 2290) and attach them to form 2290. Expressefile offers the lowest price of $14.90 for filing the form 2290. Claim suspension from the tax when a vehicle is expected to be used 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period; You must file form 2290 and schedule. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Web discover comprehensive form 2290 instructions for filing your heavy vehicle use tax with ease. By understanding the key points, adhering to deadlines, and avoiding common mistakes, you can ensure a smooth filing process. Fill out the heavy highway vehicle use tax return. Expressefile offers the lowest price of $14.90 for filing the form 2290. Web you must file this form 2290 (rev. This revision if you need to file a return for a tax period that began on or before june 30, 2019. Get schedule 1 in minutes. Report used vehicles that you purchased and also claim credits for vehicles that were. *see page 2 of the instructions for information on logging vehicles. Filing online is simple, fast & secure. Web figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases, and the vehicle falls into a new category; File your form 2290 online and get your stamped schedule 1 in minutes. Get schedule. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the. Web simple & secure service for form 2290. File your form 2290 online and get your stamped schedule 1 in minutes. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle. Browse 11 form 2290 templates collected for any of your needs. Claim suspension from the tax when a vehicle is expected to be used 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period; This revision if you need to file a return for a tax period that began on or before june 30, 2019. July. Web simple & secure service for form 2290 online filing. File your form 2290 online and get your stamped schedule 1 in minutes. Get schedule 1 in minutes. Web form 2290 is a crucial requirement for owners and operators of heavy vehicles to fulfill their heavy highway vehicle use tax obligations. Web you must file form 2290 and schedule 1. Web report suspended vehicles that are going to be driven less than 5,00 miles in the tax period. Web download form 2290 for current and previous years. Irs form 2290 is often used in truck tax, heavy highway vehicle use tax return, vehicle taxes, tax deadline, use tax, tax refund form, tax payment form, u.s. The purpose of the tax is to help fund the. File your form 2290 online and get your stamped schedule 1 in minutes. Claim suspension from the tax when a vehicle is expected to be used 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the period; Web form 2290 is a crucial requirement for owners and operators of heavy vehicles to fulfill their heavy highway vehicle use tax obligations. Browse 11 form 2290 templates collected for any of your needs. Web schedule 1 (form 2290) (rev. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period. Web figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases, and the vehicle falls into a new category; Web the form 2290 is a tax return that must be filed by anyone who owns or operates a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more that is used on a public highway. Web form 2290 must be filed by the last day of the month followed by the month of the first use of the taxable vehicles. Web simple & secure service for form 2290 online filing. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. Web discover comprehensive form 2290 instructions for filing your heavy vehicle use tax with ease.2024 2290 Forms Printable

Printable 2290 Form

Printable 2290 Form Customize and Print

Irs Form 2290 Printable

2290 Form Printable

Irs Form 2290 Printable

2290 Form Printable

2290 Form Printable

Irs Printable Form 2290 Printable Forms Free Online

Ssurvivor 2290 Tax Form Printable

Web Complete Both Copies Of Schedule 1 (Form 2290) And Attach Them To Form 2290.

The Current Period Begins From July 1, 2024 To June 30, 2025.

Expressefile Offers The Lowest Price Of $14.90 For Filing The Form 2290.

This Revision If You Need To File A Return For A Tax Period That Began On Or Before June 30, 2019.

Related Post: