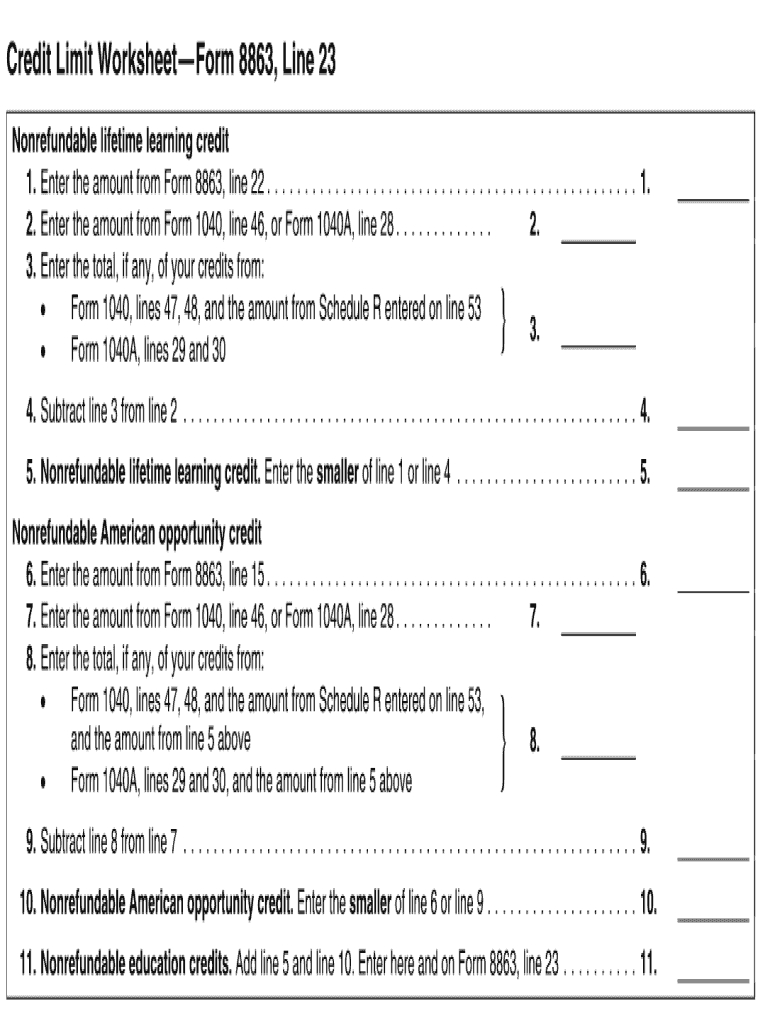

Credit Limit Worksheet A Printable

Credit Limit Worksheet A Printable - Worksheets are credit eic 1 of 44 1339,. Bbb a+ rated businesscancel anytimeover 100k legal forms I believe you are referring to the credit limit worksheet in the instructions to. Enter the amount from line 11 of. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Part i child tax credit and credit for other dependents. If you file form 2555, you cannot. Use the credit limit worksheet to gain insights into how credit utilization. Use form 8863 to figure and claim your education credits, which are based on adjusted. Up to $32 cash back the credit limit worksheet of form 8863 is an important tool for. The irs credit limit worksheet helps taxpayers calculate the maximum amount. Make the most of it and complete your credit limit worksheet for 8863 safely. Use form 8863 to figure and claim your education credits, which are based on adjusted. Enter the amount from line 11 of. Part i child tax credit and credit for other dependents. Complete the credit limit worksheet b only if you meet all of the following. you. Up to $50 cash back use form 8863 to figure and claim your education credits, which are. Use the credit limit worksheet to gain insights into how credit utilization. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Save timefor teachers by teacherscovers all age groups3 million resources Use the credit limit worksheet to gain insights into how credit utilization. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Up to $32 cash back the credit limit worksheet of form 8863 is an important tool for. The irs credit limit worksheet helps taxpayers calculate the maximum amount. Complete the credit limit. Enter the amount from line 11 of. Use form 8863 to figure and claim your education credits, which are based on adjusted. Worksheets are credit eic 1 of 44 1339,. If you file form 2555, you cannot. I believe you are referring to the credit limit worksheet in the instructions to. Enter the amount from line 11 of. Save timefor teachers by teacherscovers all age groups3 million resources Complete the credit limit worksheet b only if you meet all of the following. you. If you file form 2555, you cannot. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Save timefor teachers by teacherscovers all age groups3 million resources Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. If you file form 2555, you cannot. Worksheets are credit eic 1 of 44 1339,. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Up to $50 cash back use form 8863 to figure and claim your education credits, which are. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Complete the credit limit worksheet b only if you meet all of the following. you. I believe you are referring to the credit limit worksheet in the. Make the most of it and complete your credit limit worksheet for 8863 safely. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Bbb a+ rated businesscancel anytimeover 100k legal forms Up to $32 cash back the credit limit worksheet of form 8863 is an important tool for. I believe you are referring. Worksheets are credit eic 1 of 44 1339,. Use form 8863 to figure and claim your education credits, which are based on adjusted. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Complete the credit limit worksheet b only if you meet all of the following. you. Part i child tax credit and. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Complete the credit limit worksheet b only if you meet all of the following. you. Up to $32 cash back the credit limit worksheet of form 8863 is an important tool for. Use the credit limit worksheet to gain insights into how credit utilization.. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Save timefor teachers by teacherscovers all age groups3 million resources Bbb a+ rated businesscancel anytimeover 100k legal forms Make the most of it and complete your credit limit worksheet for 8863 safely. Part i child tax credit and credit for other dependents. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Make the most of it and complete your credit limit worksheet for 8863 safely. If you file form 2555, you cannot. Complete the credit limit worksheet b only if you meet all of the following. you. I believe you are referring to the credit. Complete the credit limit worksheet b only if you meet all of the following. you. I believe you are referring to the credit limit worksheet in the instructions to. Up to $32 cash back the credit limit worksheet of form 8863 is an important tool for. The irs credit limit worksheet helps taxpayers calculate the maximum amount. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. Use the credit limit worksheet to gain insights into how credit utilization. Enter the amount from line 11 of. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other depend. If you file form 2555, you cannot. Worksheets are credit eic 1 of 44 1339,. Bbb a+ rated businesscancel anytimeover 100k legal forms Save timefor teachers by teacherscovers all age groups3 million resourcescredit limit worksheet Fill Online, Printable, Fillable Blank form

Credit limit worksheet a 2022 form Worksheets Library

Credit Limit Worksheet A Printable And Enjoyable Learning

Form 8812 Credit Limit Worksheet A

Credit Limit Worksheet A Pdf

Credit Limit Worksheet A Schedule 8812

2022 Instructions for Schedule 8812 (2022) Internal Revenue Service

Form 8863 Credit Limit Worksheet Printable Word Searches

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

2022 Instructions for Schedule 8812 (2022) Internal Revenue Service

Use Form 8863 To Figure And Claim Your Education Credits, Which Are Based On Adjusted.

Up To $50 Cash Back Use Form 8863 To Figure And Claim Your Education Credits, Which Are.

Part I Child Tax Credit And Credit For Other Dependents.

Make The Most Of It And Complete Your Credit Limit Worksheet For 8863 Safely.

Related Post: