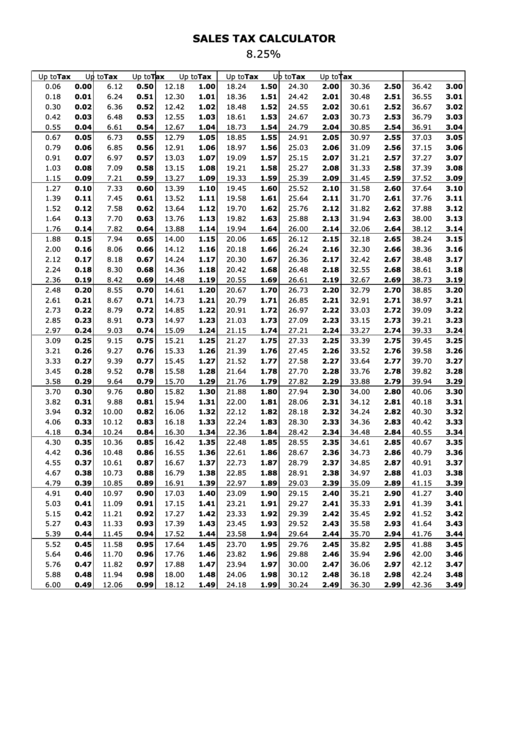

8.25 Sales Tax Chart Printable

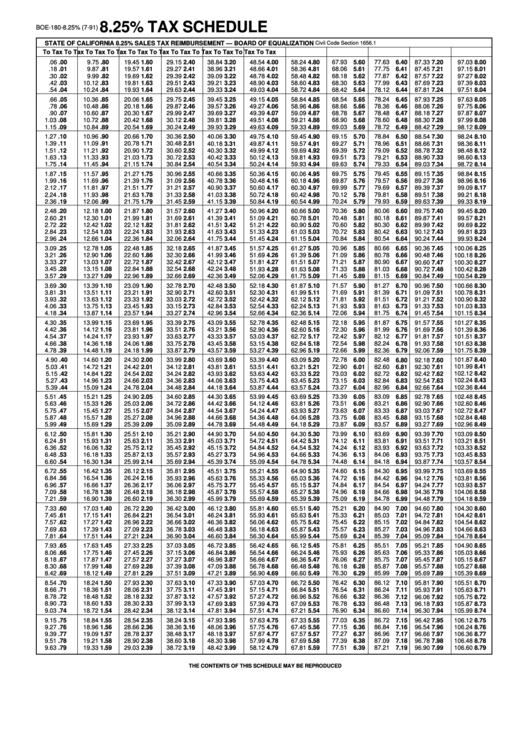

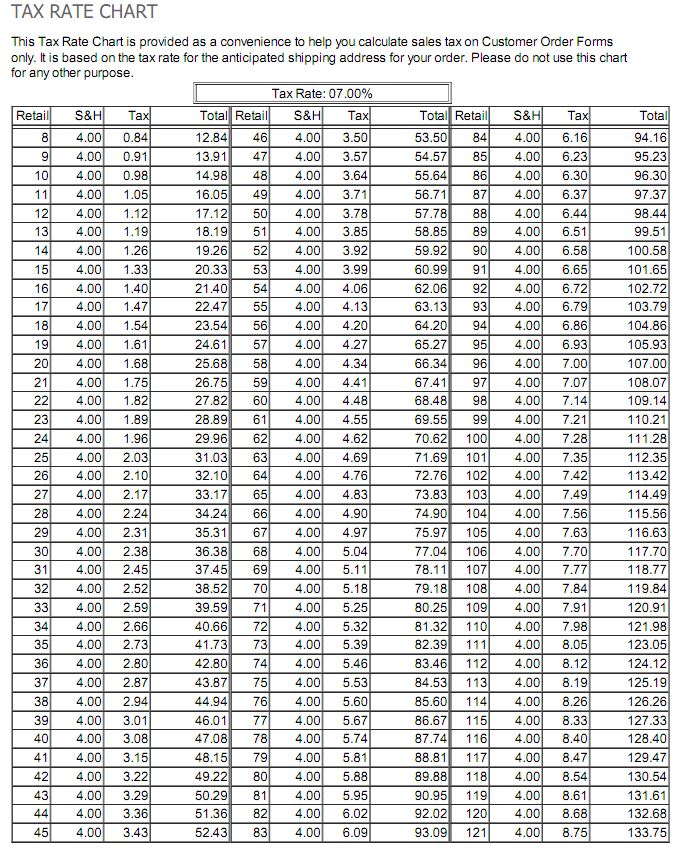

8.25 Sales Tax Chart Printable - City of san rafael 9.25%. Web sales and use tax rates madera county 7.75%. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country flourishes. 70 * 0.065 = 4.55 you will pay $4.55 in tax on a $70 item add tax to list price to get total price: To use this chart, locate the row that contains the purchase price. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. 6.5 / 100 = 0.065 multiply price by decimal tax rate: Town of corte madera 9.00%. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. Web sales and use tax rates madera county 7.75%. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. To use this chart, locate the row that contains the purchase price. Transactions between companies are not subject to this tax. 70 + 4.55 = $74.55 sales tax calculation formulas sales tax rate = sales tax percent / 100 sales tax = list price * sales tax rate 70 * 0.065 = 4.55 you will pay $4.55 in tax on a $70 item add tax to list price to get total price: Sales tax is one of these. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country flourishes. Town of corte madera 9.00%. Most often, this tax is levied on the final buyer. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Transactions between companies are not subject to this tax. Quickest way to calculate it we all have to pay taxes so that. Most often, this tax is levied on the final buyer. Town of corte madera 9.00%. Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts.. Web divide tax percentage by 100: Web sales and use tax rates madera county 7.75%. Most often, this tax is levied on the final buyer. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country flourishes. 70 * 0.065 = 4.55 you will pay $4.55 in tax on. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Town of san anselmo 9.25%. City of san rafael 9.25%. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. Web 8.25% tax schedule the contents of this schedule may be reproduced state of california 8.25% sales tax reimbursement — california department of tax and fee administration civil code section 1656.1 to Web divide tax percentage by 100: Quickest way to. Web divide tax percentage by 100: Sales tax is one of these. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Most often, this tax is levied on the final buyer. These aids may seem difficult to make, but technology has. Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. Web sales and use tax rates madera county 7.75%. City of san rafael 9.25%. Web. Web sales tax calculator | sales tax table sales tax table this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal. Web 8.25% tax schedule the contents of this schedule may be reproduced state of california 8.25% sales tax reimbursement — california department of tax and fee administration civil code section 1656.1 to To use this chart, locate the row that contains the purchase price. Sales tax is one of these. 70 * 0.065 = 4.55 you will pay $4.55 in. Web 8.25% sales tax calculator online. Most often, this tax is levied on the final buyer. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web 8.25% tax schedule the contents of this schedule may be reproduced state of california 8.25%. Most often, this tax is levied on the final buyer. 70 * 0.065 = 4.55 you will pay $4.55 in tax on a $70 item add tax to list price to get total price: City of san rafael 9.25%. Web 8.25 sales tax chart printable by tammy croft charts and graphs provide an ideal visual explanation for business plans, marketing strategies and other reporting activities. Web 8.25% tax schedule the contents of this schedule may be reproduced state of california 8.25% sales tax reimbursement — california department of tax and fee administration civil code section 1656.1 to Transactions between companies are not subject to this tax. Web sales and use tax rates madera county 7.75%. These aids may seem difficult to make, but technology has made it easier to create professional and elaborate charts. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Town of corte madera 9.00%. 6.5 / 100 = 0.065 multiply price by decimal tax rate: Web 8.25% sales tax calculator online. Quickest way to calculate it we all have to pay taxes so that the state can fulfill its functions, and our country flourishes. Web divide tax percentage by 100: Town of san anselmo 9.25%.8.25 Sales Tax Calculator Online. Quickest Way to Calculate it

Sales Tax Calculator 8.25 printable pdf download

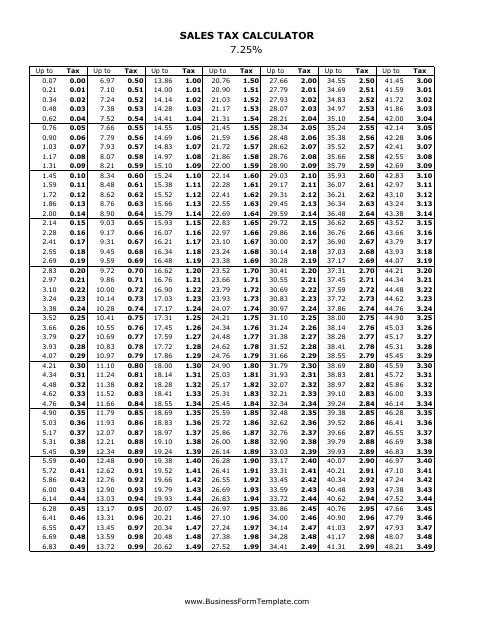

7.25 Sales Tax Chart Printable Printable Word Searches

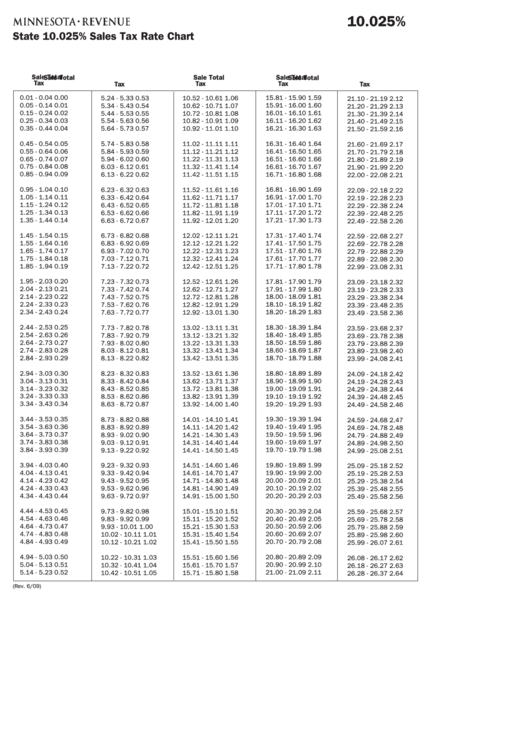

Printable Sales Tax Chart Portal Tutorials

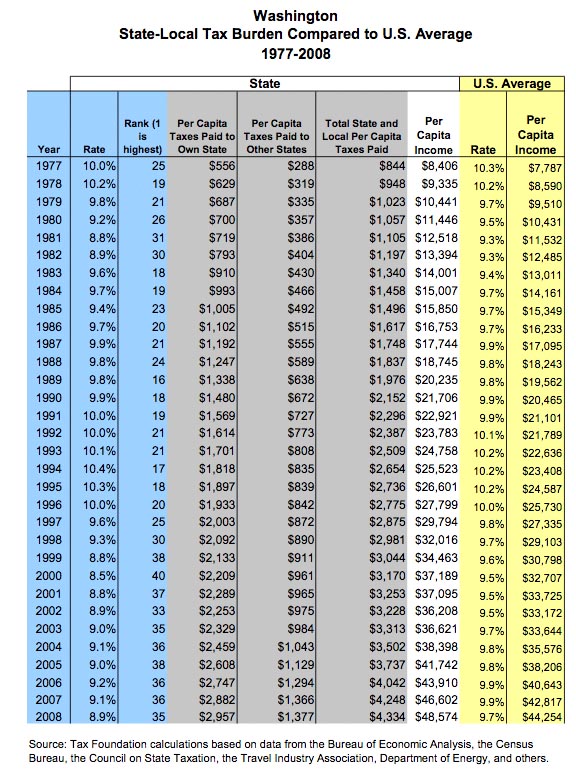

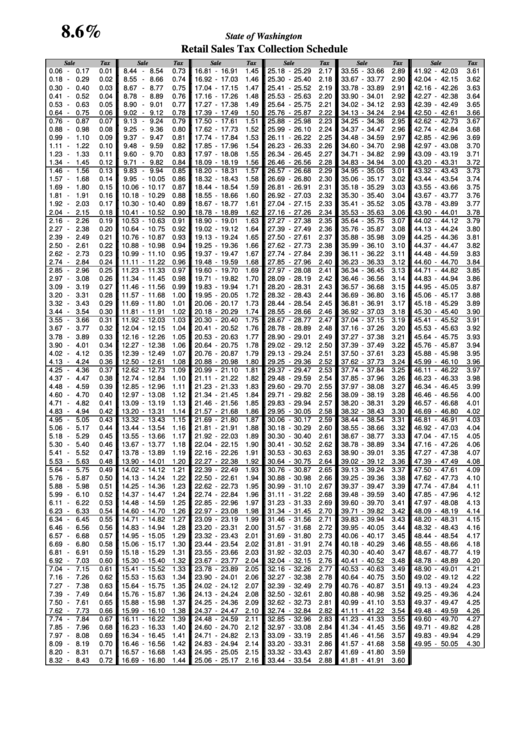

Tax Chart United Faculty of Washington State

Printable Sales Tax Chart Portal Tutorials

Form Boe1808.25 State Of California 8.25 Sales Tax Reimbursement

Regional sales tax numbers dip slightly, remain strong UCBJ Upper

Printable Sales Tax Chart Portal Tutorials

7.25 Sales Tax Chart Printable Printable Word Searches

Sales Tax Is One Of These.

70 + 4.55 = $74.55 Sales Tax Calculation Formulas Sales Tax Rate = Sales Tax Percent / 100 Sales Tax = List Price * Sales Tax Rate

Web Sales Tax Calculator | Sales Tax Table Sales Tax Table This Sales Tax Table (Also Known As A Sales Tax Chart Or Sales Tax Schedule) Lists The Amount Of Sales Tax Due On Purchases Between $0.00 And $59.70 For A 5% Sales Tax Rate.

To Use This Chart, Locate The Row That Contains The Purchase Price.

Related Post: