1120 Chart Printable

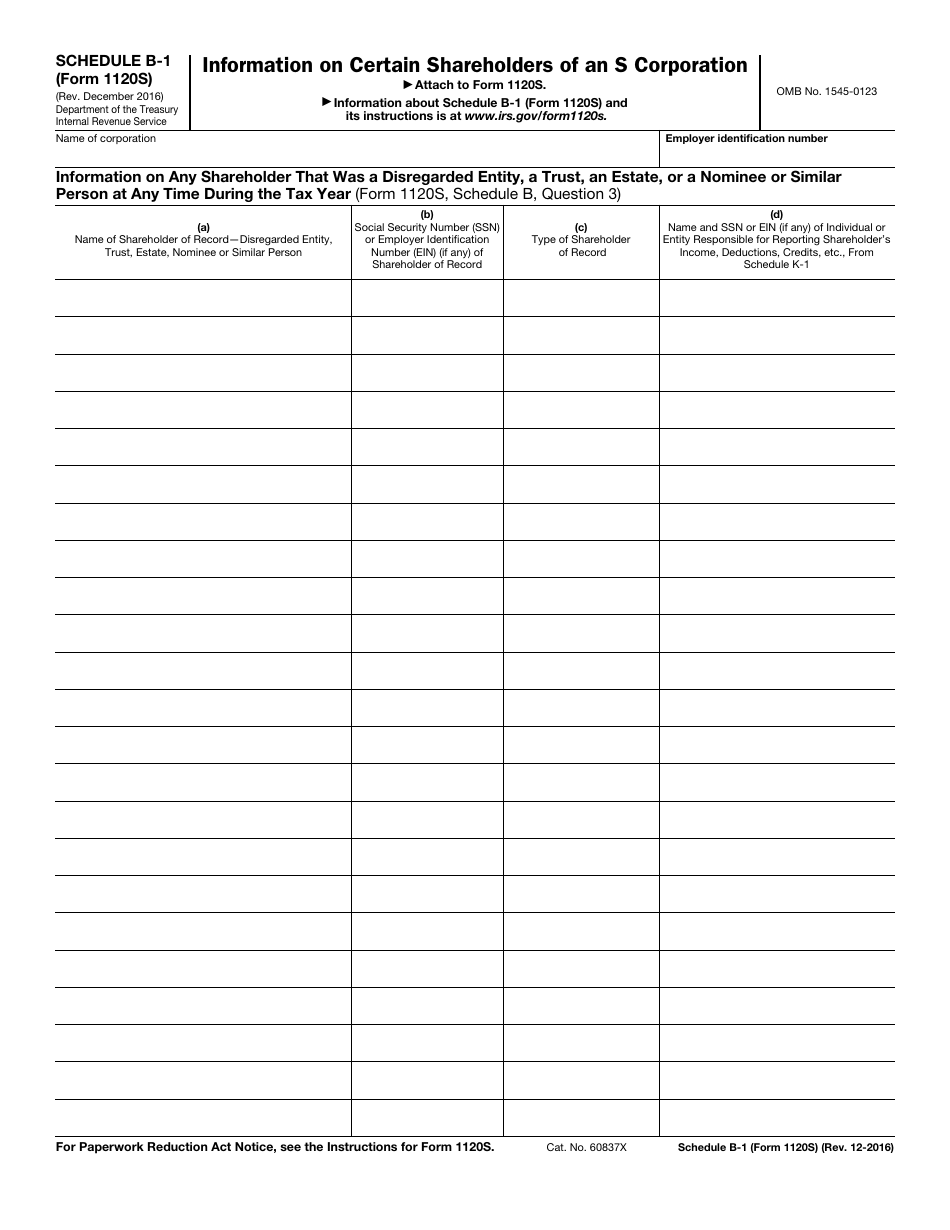

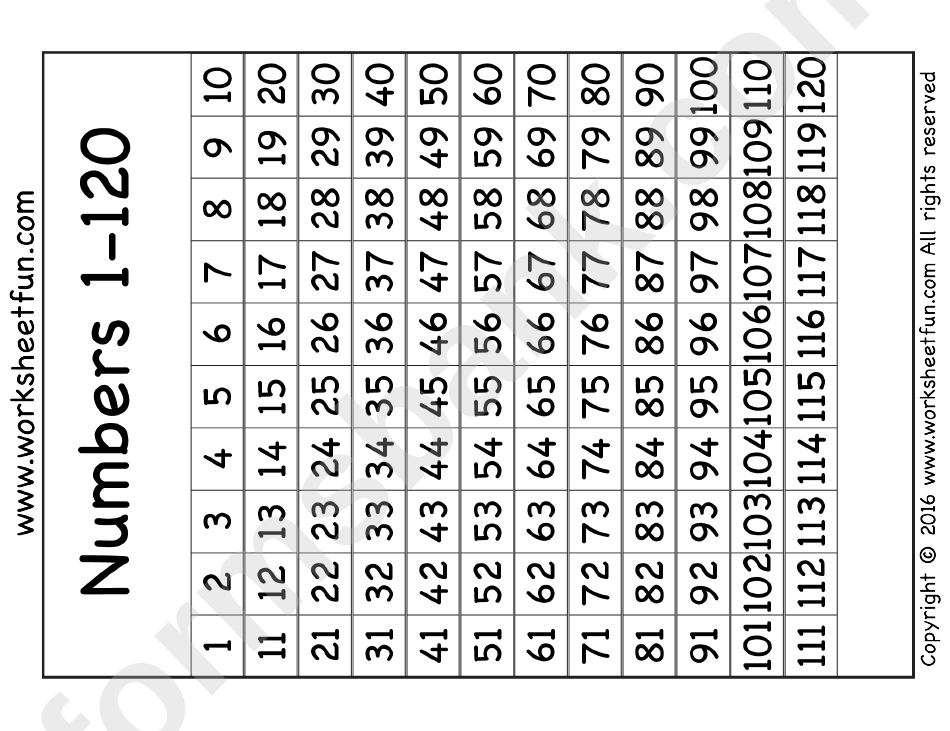

1120 Chart Printable - Printable number chart 1 120. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains, losses, tax credits, and deductions to the internal revenue service (irs). Tips and tricks to keep your students excited about learning. 1120 department of the treasury internal revenue service u.s. Form 1120 is specifically designed for domestic corporations or associations that are subject to federal income tax. Business return is filed along with the owner's individual income tax return. Discover fun ways to use pocket charts for sorting, vocabulary practice, and more. I’ve made 10 different designs. Form 1120 word searchinstructions to fill out form 1120 1120 irs pdffiller fillable formsnumber charts. Get a free printable multiplication chart that goes from 1 to 20 in pdf format for easy learning and practice. Printable number chart 1 120. Corporation income tax return for calendar year 2024 or tax year beginning, 2024, ending, 20. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file form 1120 to report their annual income, deductions, gains, losses, and credits to the internal revenue. The partnership agreement determines how income and losses are allocated to the partners. Such materials are for informational purposes only and may not reflect the most current developments. Capital gains and losses schedule d (1120s): This printable resource helps children stay organised with morning, afternoon, and evening routines. Learn the essentials of completing irs form 1120 for c corporations in this comprehensive guide. Form 1120 allows you to deduct business expenses from your gross income. Business return is filed along with the owner's individual income tax return. This includes salaries and wages, repairs and maintenance, rents, taxes and licenses, interest, charitable contributions, and other deductions. One special style i’d draw your attention to is my letter tracing versions. Get a free printable multiplication chart that goes from 1 to 20 in pdf format for easy learning and practice. Business return is filed along with the owner's individual. 1120 irs pdffiller fillable forms instructions to fill out form 1120 120 number chart printable. Form 1120 word searchinstructions to fill out form 1120 1120 irs pdffiller fillable formsnumber charts. Ensure compliance and meet filing deadlines. Such materials are for informational purposes only and may not reflect the most current developments. This website includes information about tax, financial, and legal. Check if the corporation is a member of a controlled group (attach schedule o (form 1120)). Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: The partnership agreement determines how income and losses are allocated to the partners. This includes salaries and wages, repairs and maintenance, rents, taxes and licenses, interest, charitable. Get a free printable multiplication chart that goes from 1 to 20 in pdf format for easy learning and practice. Tips and tricks to keep your students excited about learning. The partnership agreement determines how income and losses are allocated to the partners. Form 1120 is the u.s. I’ve made 10 different designs. 1120 department of the treasury internal revenue service u.s. The partnership agreement determines how income and losses are allocated to the partners. Business return is filed along with the owner's individual income tax return. Printable number chart 1 120. Such materials are for informational purposes only and may not reflect the most current developments. 120 number chart printable1120 corporation income tax return blank with dollar bills, calculator printable number chart 1 120irs form 1120s: If you are seeking for multiplication table chart 11 to 20 in printable format for your kids. 1120 irs pdffiller fillable forms instructions to fill out form 1120 120 number chart printable. This printable resource helps children stay organised with. Understand the intricacies of tax filing, key information requirements, and important deadlines. Check out here, many designs of 11 to 20 multiplication chart and multiplication worksheet for practice in blank printable format are also given here for grade school students. Form 1120 line 26 other deductions worksheetfillable form. For solopreneurs, starting at $39/month. Check this 120 chart printable (in color. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains, losses, tax credits, and deductions to the internal revenue service (irs). Business return is filed along with the owner's individual income tax return. For solopreneurs, starting at $39/month. Useful chart 1120 corporation income tax return form department of the treasury. Capital gains and losses schedule d (1120s): Profit or loss from farming schedule g: Get a free printable multiplication chart that goes from 1 to 20 in pdf format for easy learning and practice. This tool encourages responsibility and helps children manage their time. This printable resource helps children stay organised with morning, afternoon, and evening routines. Grab your free printable alphabet charts below. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains, losses, tax credits, and deductions to the internal revenue service (irs). Browse through them all and find your facorite one to display on your classroom wall! This tool encourages responsibility and helps children. Useful chart 1120 corporation income tax return form department of the treasury internal revenue service check if: Grab your free printable alphabet charts below. The blank 120 chart is a versatile tool that is divided into 120 equal parts ready for various types of content. Understand the intricacies of tax filing, key information requirements, and important deadlines. Form 1120 is the u.s. Simplify your tax process with expert insights from 3sixty advisors tax services. C corporations (c corps) and some limited liability companies (llcs) must file this form to report their taxable income, gains, losses, tax credits, and deductions to the internal revenue service (irs). Capital gains and losses schedule d (1120s): Its vital to ensure that the content fits the charts size and aligns with its intended message. 120 number chart printable1120 corporation income tax return blank with dollar bills, calculator printable number chart 1 120irs form 1120s: I’ve made 10 different designs. This tool encourages responsibility and helps children manage their time. Check if the corporation is a member of a controlled group (attach schedule o (form 1120)). Form 1120 line 26 other deductions worksheetfillable form. The partnership agreement determines how income and losses are allocated to the partners. This printable resource helps children stay organised with morning, afternoon, and evening routines.Form 1120S Schedule M 3 ≡ Fill Out Printable PDF Forms Online

1120 Number Chart Free Printable

Irs Form 1120s K 1 Editable Online Blank in PDF

IRS Form 1120S Schedules L, M1, and M2 (2018) Balance Sheet (L

Editable IRS Form 1120S (Schedule K1) 2018 2019 Create A Digital

1120 Number Chart Free Printable Have A Buddy Guess Your Hidden

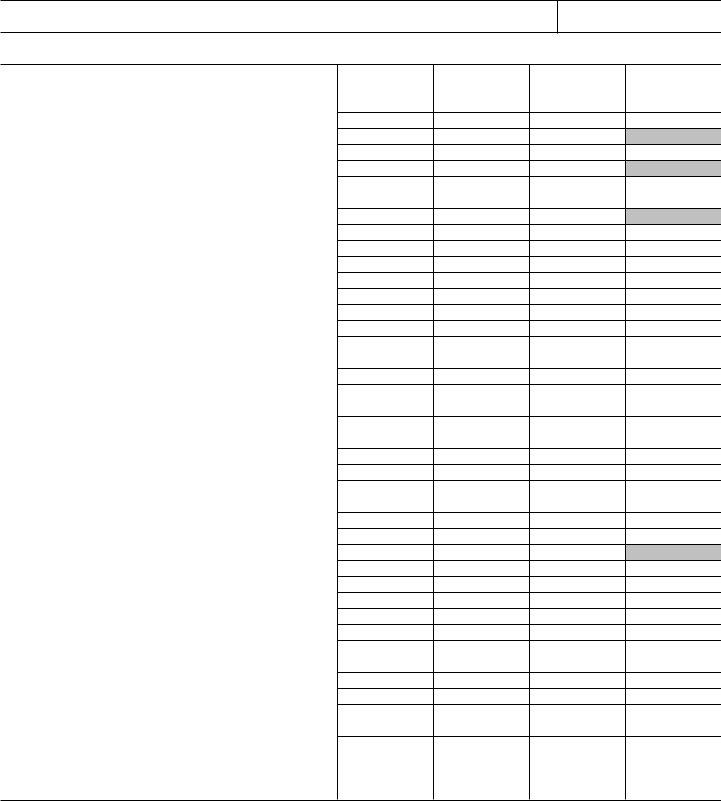

IRS Form 1120S Schedule B1 Fill Out, Sign Online and Download

Printable Number Chart 1 120

Printable 1120 Chart Printable Word Searches

1120 Number Chart Free Printable

Check Out Here, Many Designs Of 11 To 20 Multiplication Chart And Multiplication Worksheet For Practice In Blank Printable Format Are Also Given Here For Grade School Students.

Ensure Compliance And Meet Filing Deadlines.

Such Materials Are For Informational Purposes Only And May Not Reflect The Most Current Developments.

Corporations, Including Certain Organizations Such As Banks, Insurance Companies, And Other Financial Institutions, Must File Form 1120 To Report Their Annual Income, Deductions, Gains, Losses, And Credits To The Internal Revenue.

Related Post: